Jensen Huang just changed Nvidia: Here’s what you need to know

PositiveFinancial Markets

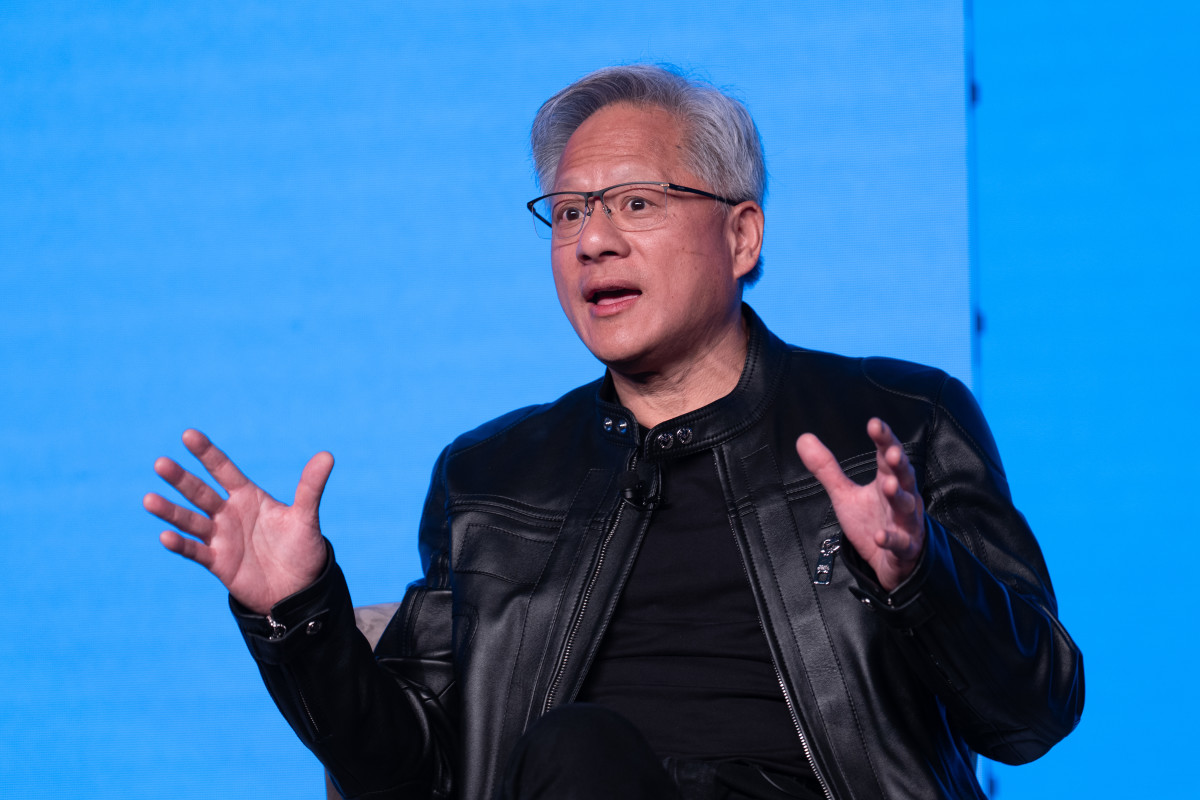

- Nvidia reported a remarkable $57 billion in sales for its third quarter, marking the ninth consecutive quarter of exceeding expectations, with a gross margin of 73.6%. CEO Jensen Huang emphasized that the narrative is not solely about financial performance but also about the transformative impact of Generative AI on the company's future.

- This strong financial performance alleviates concerns regarding a potential slowdown in the AI sector, reinforcing Nvidia's position as a leader in the market. Huang's insights suggest a strategic pivot towards AI, which is expected to drive future growth.

- The positive earnings report has sparked discussions about the sustainability of the tech rally, with Huang asserting there is no AI bubble. This sentiment contrasts with investor anxieties, highlighting the ongoing debate about the long

— via World Pulse Now AI Editorial System