BlueBay Gears Up for First Japan Bond Fund in Untapped Market

PositiveFinancial Markets

- RBC BlueBay Asset Management plans to introduce its inaugural yen

- This move signifies BlueBay's strategic entry into a previously untapped market, aiming to attract investors seeking opportunities in Japan's evolving economic landscape.

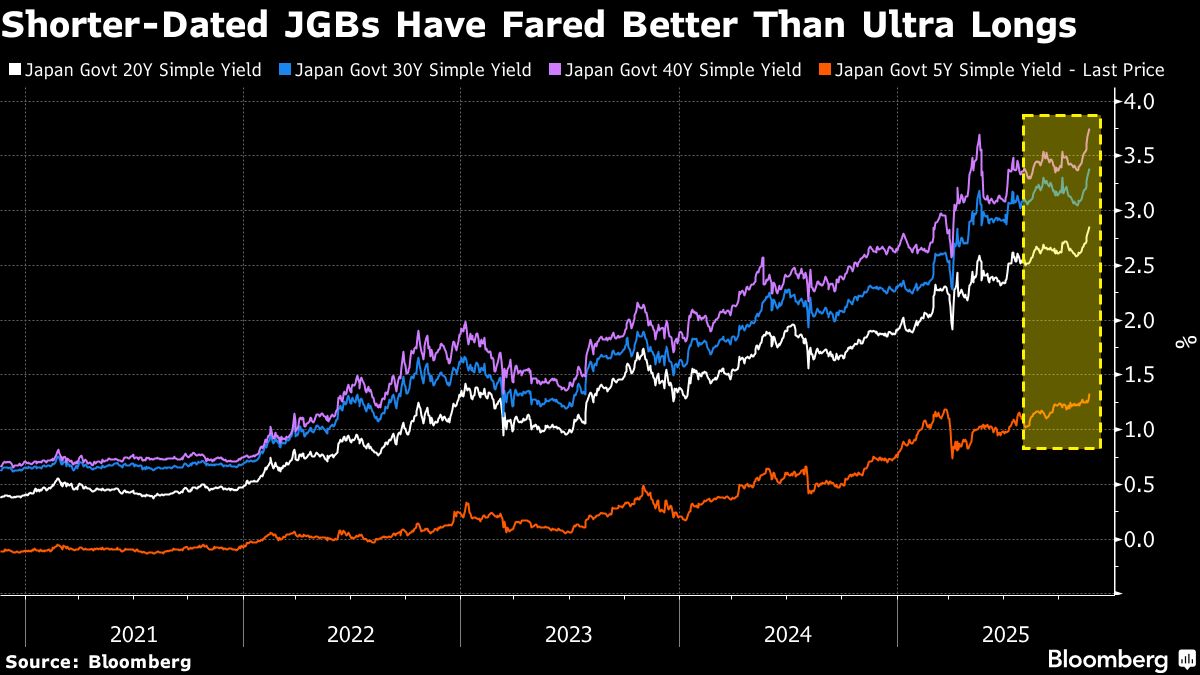

- However, the backdrop of declining Japanese government bonds and investor skepticism regarding the effectiveness of upcoming stimulus measures raises questions about the overall market sentiment and potential challenges ahead.

— via World Pulse Now AI Editorial System