Hamas reasserts control and settles scores in Gaza Strip

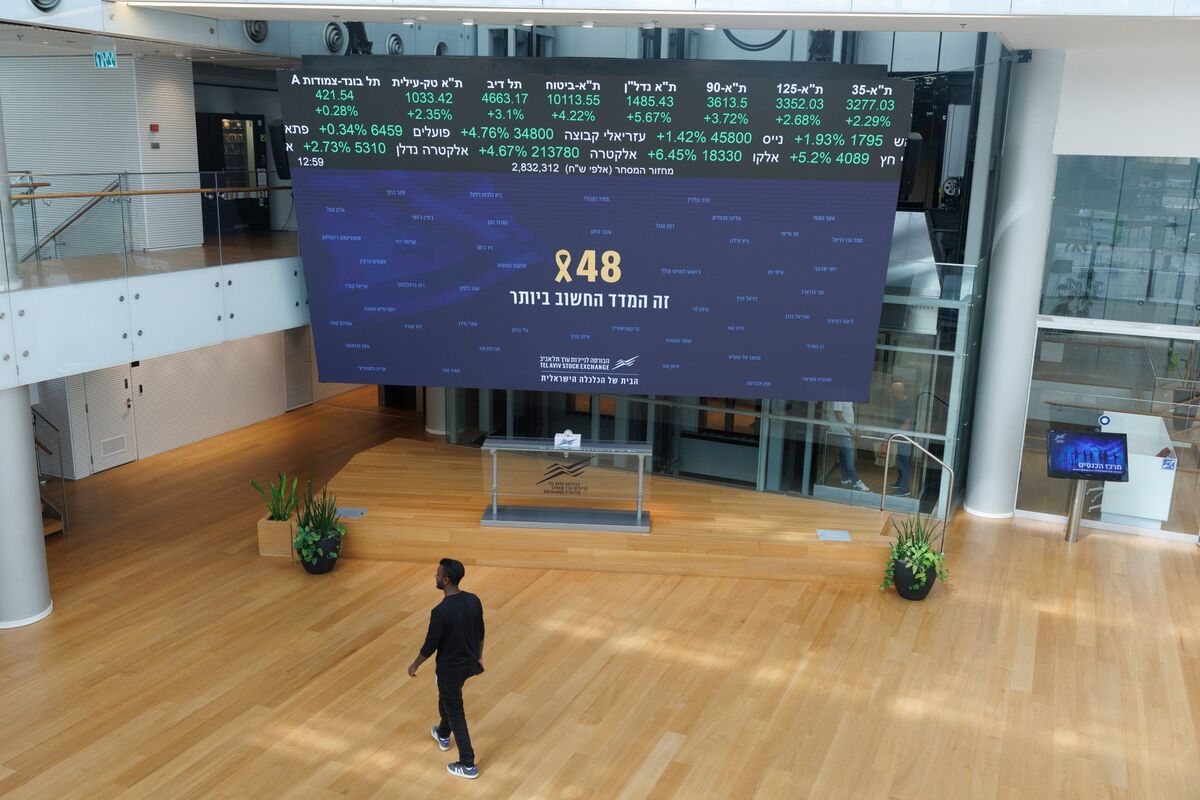

NegativeFinancial Markets

Hamas has reasserted its control over the Gaza Strip by battling rival factions and punishing those suspected of collaboration, just hours after agreeing to a ceasefire. This development is significant as it highlights the ongoing tensions and power struggles within the region, raising concerns about stability and the humanitarian situation for civilians caught in the crossfire.

— Curated by the World Pulse Now AI Editorial System