A New Rate-Cut Cycle Could Be Fuel on the Stock Market Fire

PositiveFinancial Markets

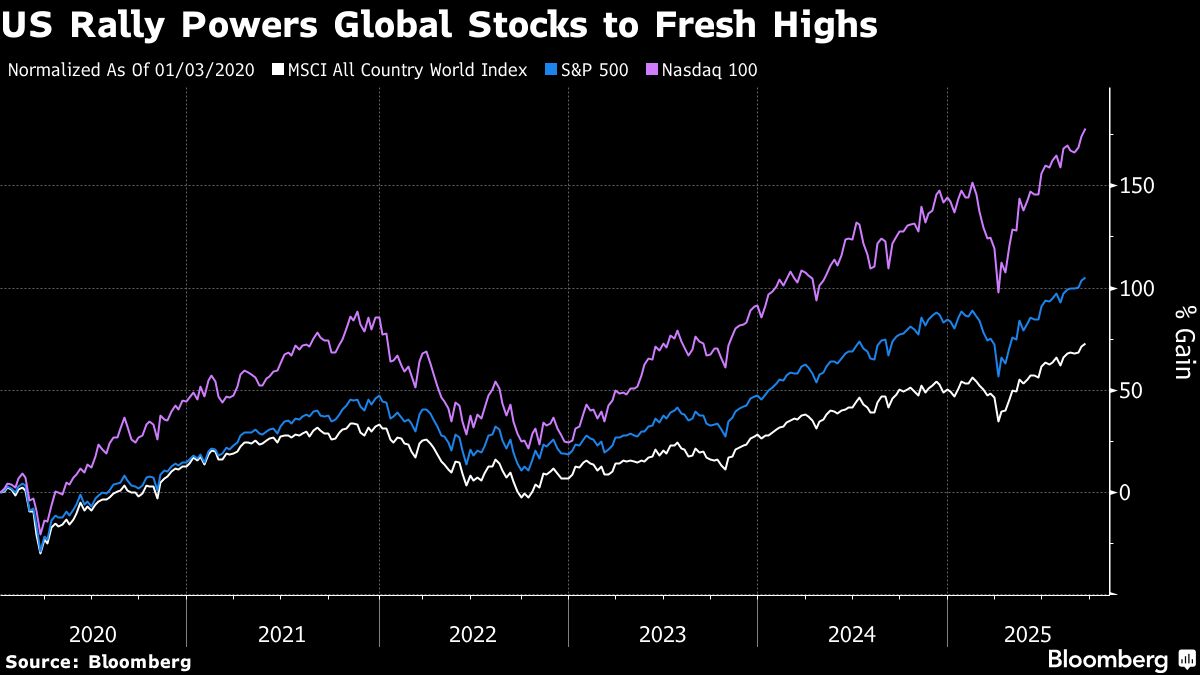

The prospect of a new rate-cut cycle by the Federal Reserve is generating excitement in the stock market, which is already experiencing significant gains. Historically, interest rate cuts during market peaks have often resulted in even greater market growth. This situation is particularly noteworthy as it comes amid presidential pressure on the Fed, suggesting that the potential for further gains could be on the horizon, making it an important moment for investors.

— Curated by the World Pulse Now AI Editorial System