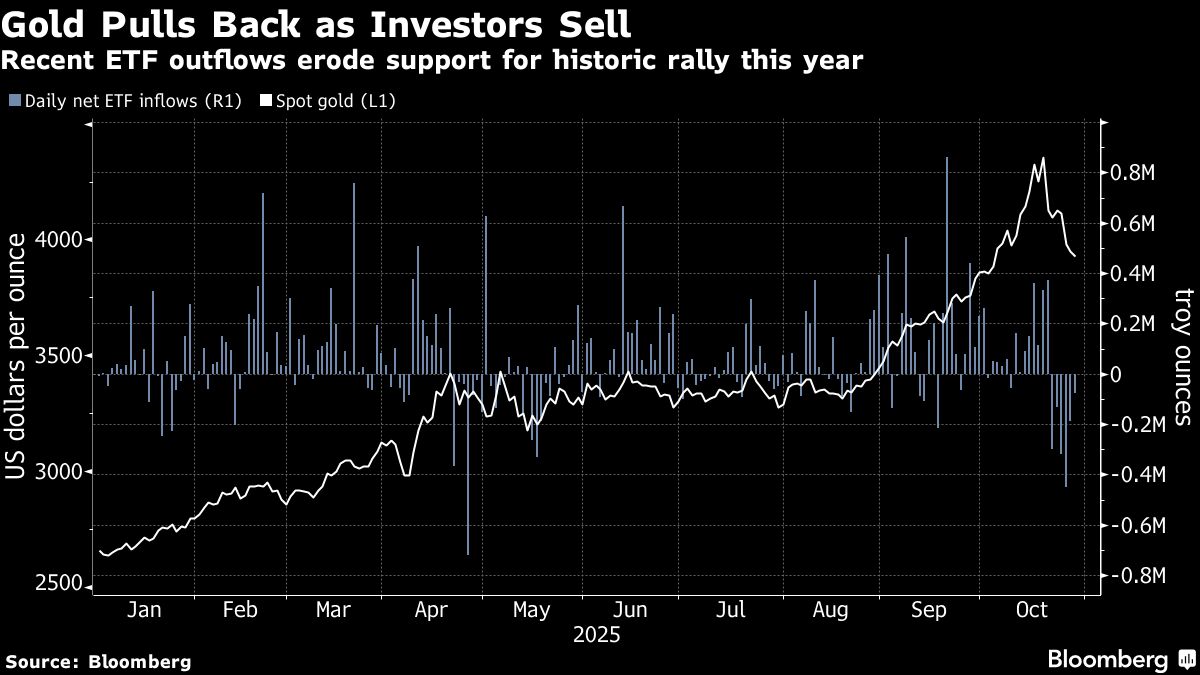

Gold Slump Holds as Fed Chair Douses Hopes for December Rate Cut

NegativeFinancial Markets

Gold prices have struggled recently, edging higher after four consecutive days of losses. This shift comes as traders reassess their expectations for a potential interest-rate cut in December, following comments from Federal Reserve Chair Jerome Powell, who downplayed the chances of such a move. This matters because it reflects the ongoing uncertainty in the market and the impact of Federal Reserve policies on commodity prices.

— Curated by the World Pulse Now AI Editorial System