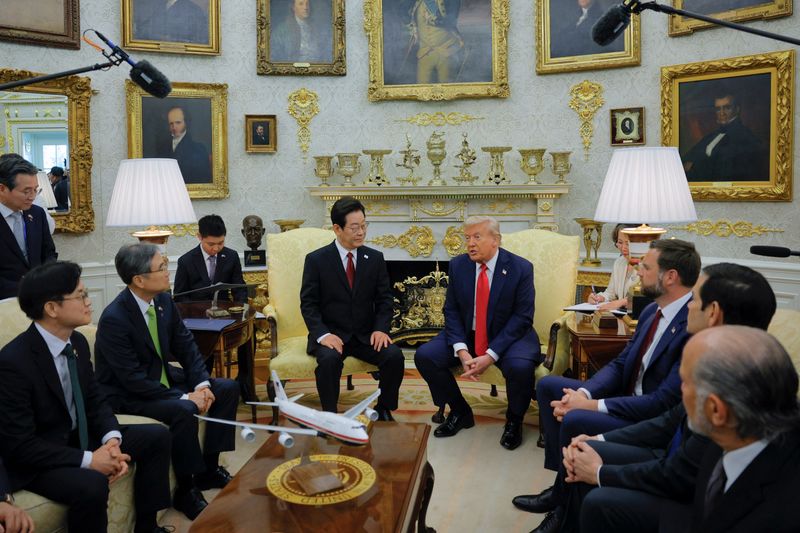

South Korea Unable to Pay $350 Billion in Cash Under Trade Pact

NegativeFinancial Markets

South Korea has announced that it is unable to pay the $350 billion in cash that the U.S. suggested as part of a trade deal aimed at lowering tariffs. This development raises concerns about the future of trade relations between the two countries and could impact economic stability in the region. The inability to meet this financial demand may lead to further negotiations and adjustments in the trade pact.

— Curated by the World Pulse Now AI Editorial System