MapLight Taps Workaround for IPO Despite Government Shutdown

PositiveFinancial Markets

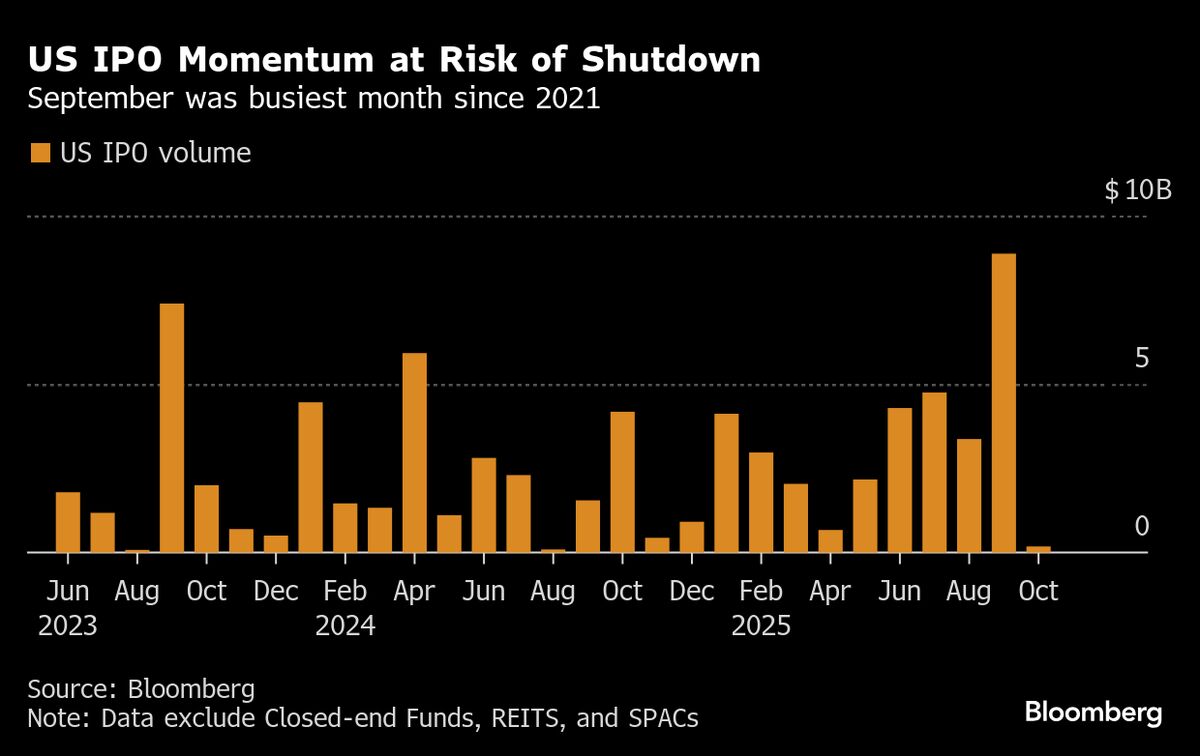

MapLight Therapeutics Inc. is making headlines by using a unique strategy to proceed with its IPO this month, despite the ongoing US government shutdown that has caused many other companies to delay their public offerings. This move not only highlights MapLight's determination but also showcases its innovative approach in a challenging environment, potentially setting a precedent for other firms looking to navigate similar obstacles.

— Curated by the World Pulse Now AI Editorial System