Trading Day: US shutdown deadline is nigh

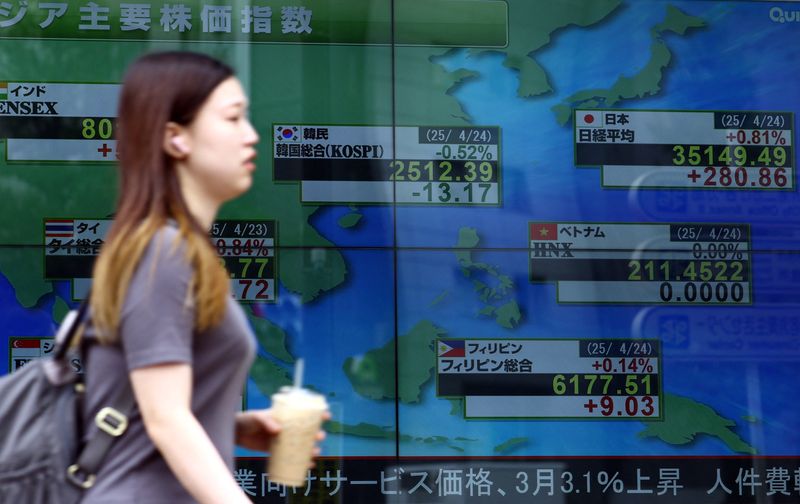

NeutralFinancial Markets

As the deadline for a potential government shutdown approaches, traders and investors are closely monitoring the situation. The implications of a shutdown could ripple through the economy, affecting everything from federal employee pay to market stability. Understanding these dynamics is crucial for making informed financial decisions in the coming days.

— Curated by the World Pulse Now AI Editorial System