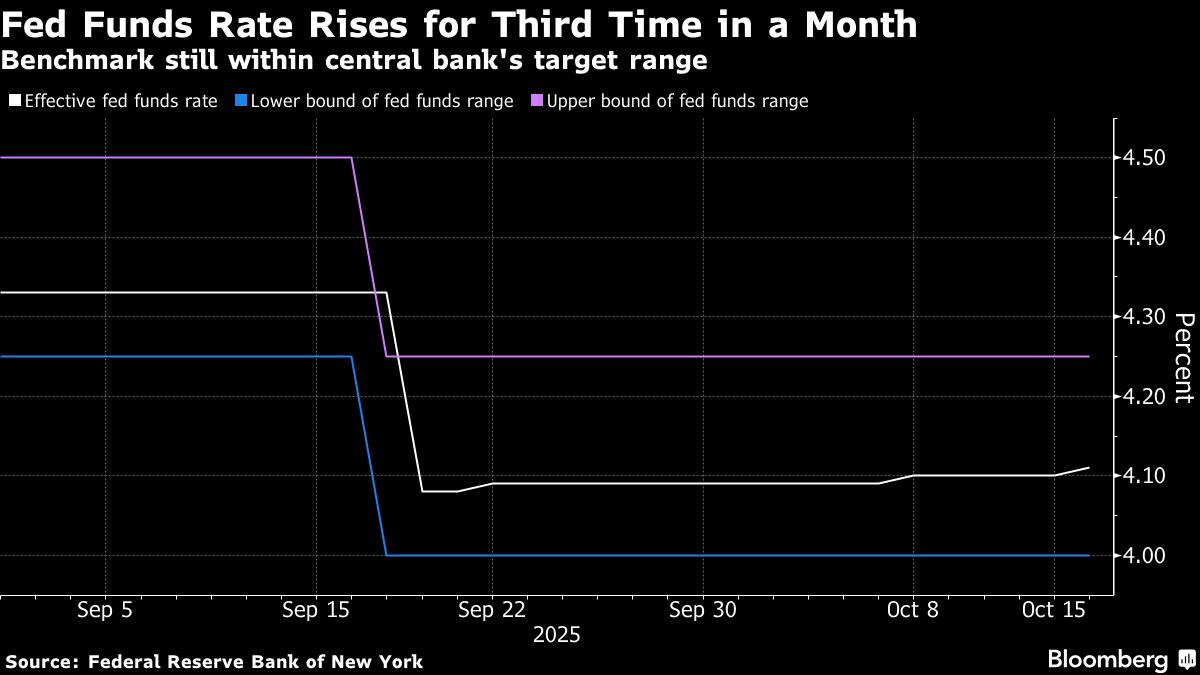

Fed’s Waller says central bank at ample reserves level

PositiveFinancial Markets

Federal Reserve official Christopher Waller has stated that the central bank currently holds ample reserves, indicating a stable financial environment. This is significant as it suggests that the Fed is well-positioned to manage monetary policy effectively, which can help maintain economic stability and support growth.

— Curated by the World Pulse Now AI Editorial System