ABB to sell robotics business to Japan’s Softbank in $5.4 bln deal

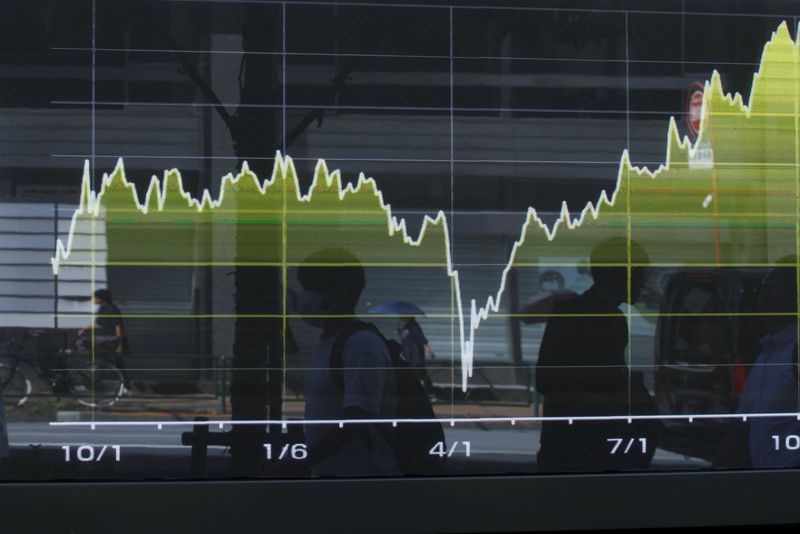

PositiveFinancial Markets

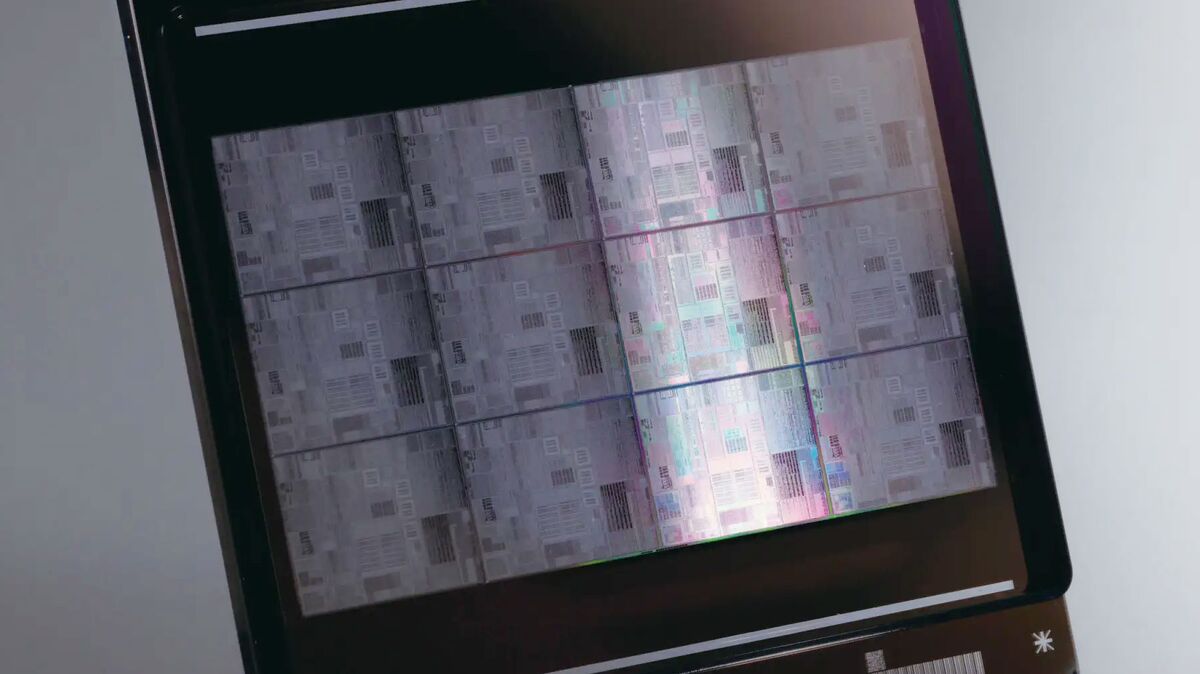

ABB's decision to sell its robotics business to Japan's Softbank for $5.4 billion marks a significant shift in the tech landscape. This deal not only highlights the growing interest in robotics but also positions Softbank to enhance its portfolio in automation technology. For ABB, this move allows them to focus on their core operations while providing Softbank with the resources to innovate further in the robotics sector. It's a win-win that could lead to exciting advancements in the industry.

— Curated by the World Pulse Now AI Editorial System