Pictet Boosts Japan Stocks, Trims Europe on Takaichi Victory

PositiveFinancial Markets

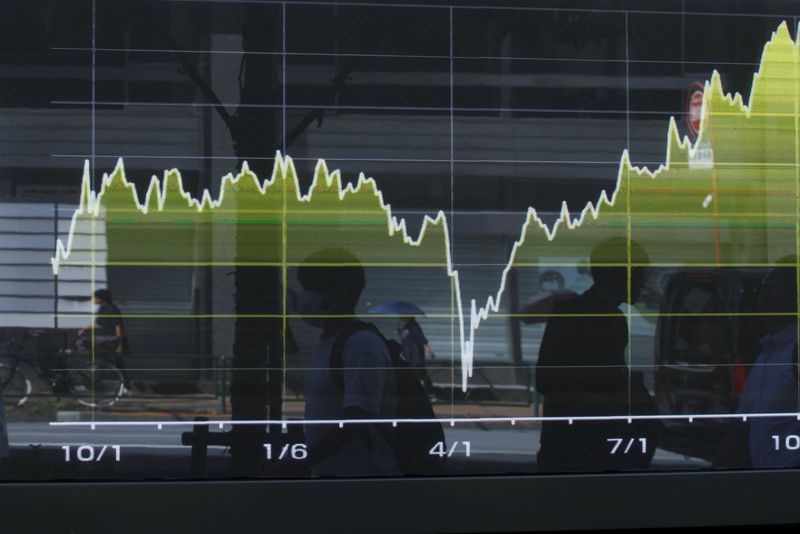

Pictet Asset Management is making a strategic shift by boosting its investments in Japanese stocks while reducing its exposure to Europe. This decision comes on the heels of Sanae Takaichi's victory in the ruling party leadership race, which is seen as a positive signal for pro-stimulus policies in Japan. This move is significant as it reflects confidence in Japan's economic outlook and could lead to increased market activity, benefiting investors looking for growth opportunities.

— Curated by the World Pulse Now AI Editorial System