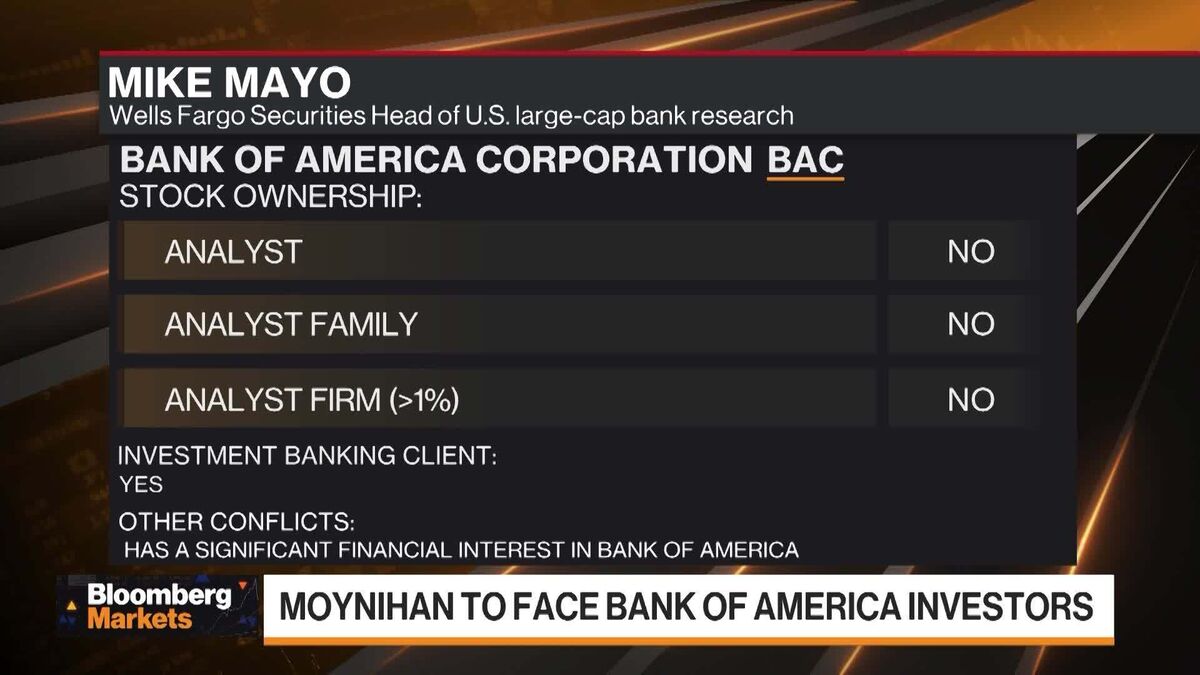

Factbox-BofA’s top brass to focus on growth plans at investor day

PositiveFinancial Markets

Factbox-BofA’s top brass to focus on growth plans at investor day

Bank of America's leadership is gearing up for an investor day where they will unveil their ambitious growth plans. This event is significant as it highlights the bank's commitment to expanding its services and improving shareholder value, which could positively impact investors and the financial market.

— via World Pulse Now AI Editorial System