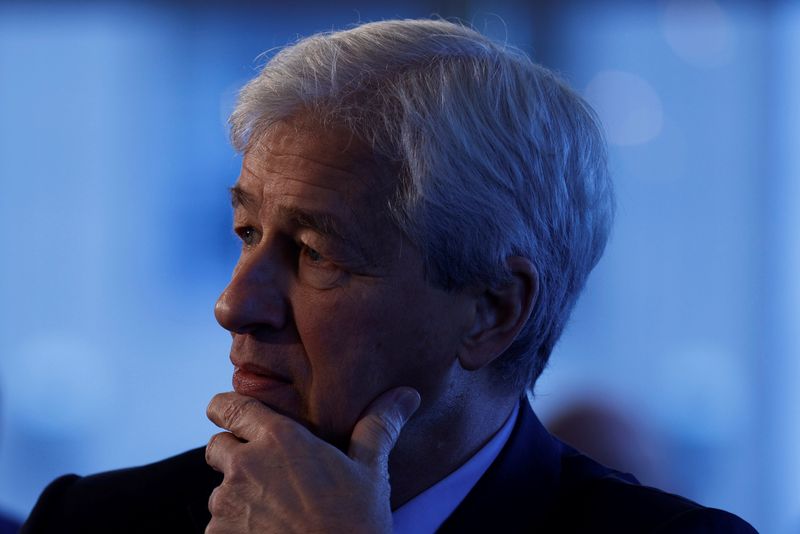

JPMorgan initiates Pattern Group stock with Overweight rating on e-commerce growth

PositiveFinancial Markets

JPMorgan has given an Overweight rating to Pattern Group's stock, highlighting the company's potential for growth in the e-commerce sector. This endorsement is significant as it reflects confidence in Pattern Group's ability to capitalize on the booming online shopping trend, which is crucial for investors looking for promising opportunities in the market.

— Curated by the World Pulse Now AI Editorial System