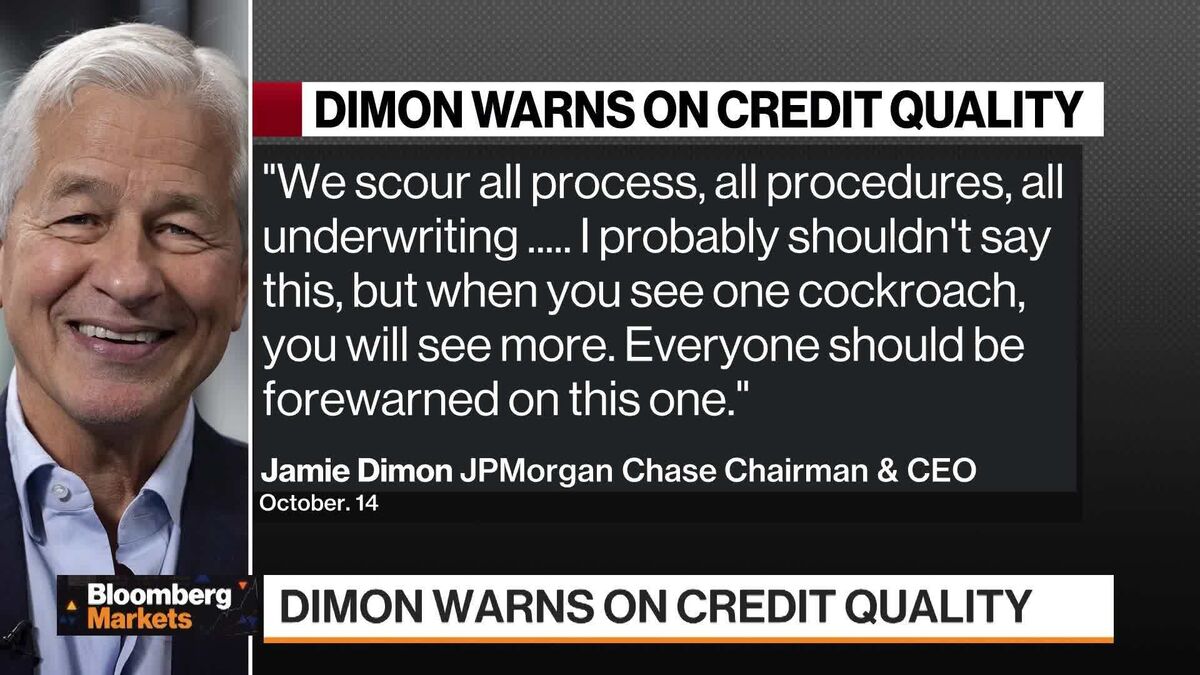

JPMorgan beats expectations in strong earnings as Jamie Dimon says the U.S. economy ‘generally remained resilient’

PositiveFinancial Markets

JPMorgan has reported strong earnings that exceeded expectations, with CEO Jamie Dimon highlighting the resilience of the U.S. economy. Each line of business within the bank performed well, showcasing its robust performance in a challenging economic landscape. This is significant as it reflects not only the bank's strength but also offers insights into the broader economic conditions, suggesting stability and potential growth.

— Curated by the World Pulse Now AI Editorial System