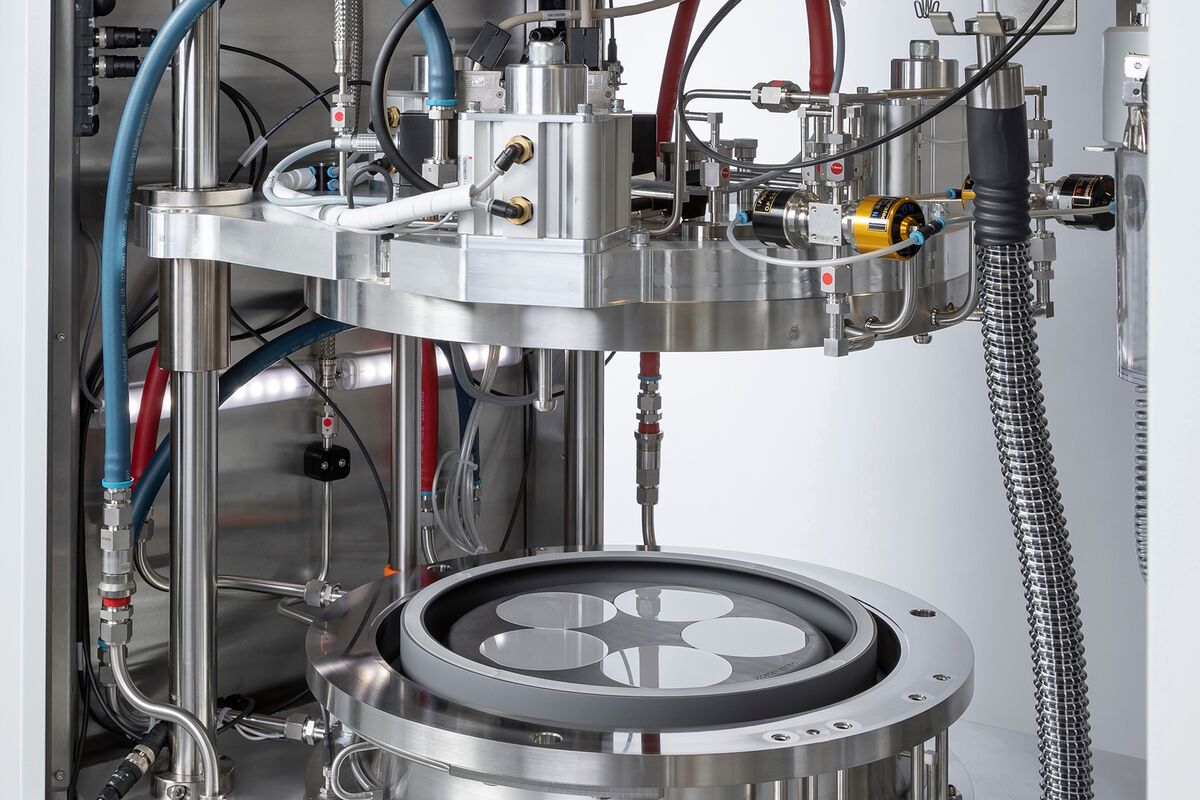

Niche Chip Stock Emerges as Europe’s Next Big AI Power Play

PositiveFinancial Markets

Niche Chip Stock Emerges as Europe’s Next Big AI Power Play

European stock investors are excited about a new niche chip stock that is being touted as the next big player in the artificial intelligence sector. This emerging opportunity highlights the growing interest and potential for AI technologies in Europe, making it a significant development for investors looking to capitalize on the tech boom.

— via World Pulse Now AI Editorial System