Lukoil unveils plans to sell its international assets

NegativeFinancial Markets

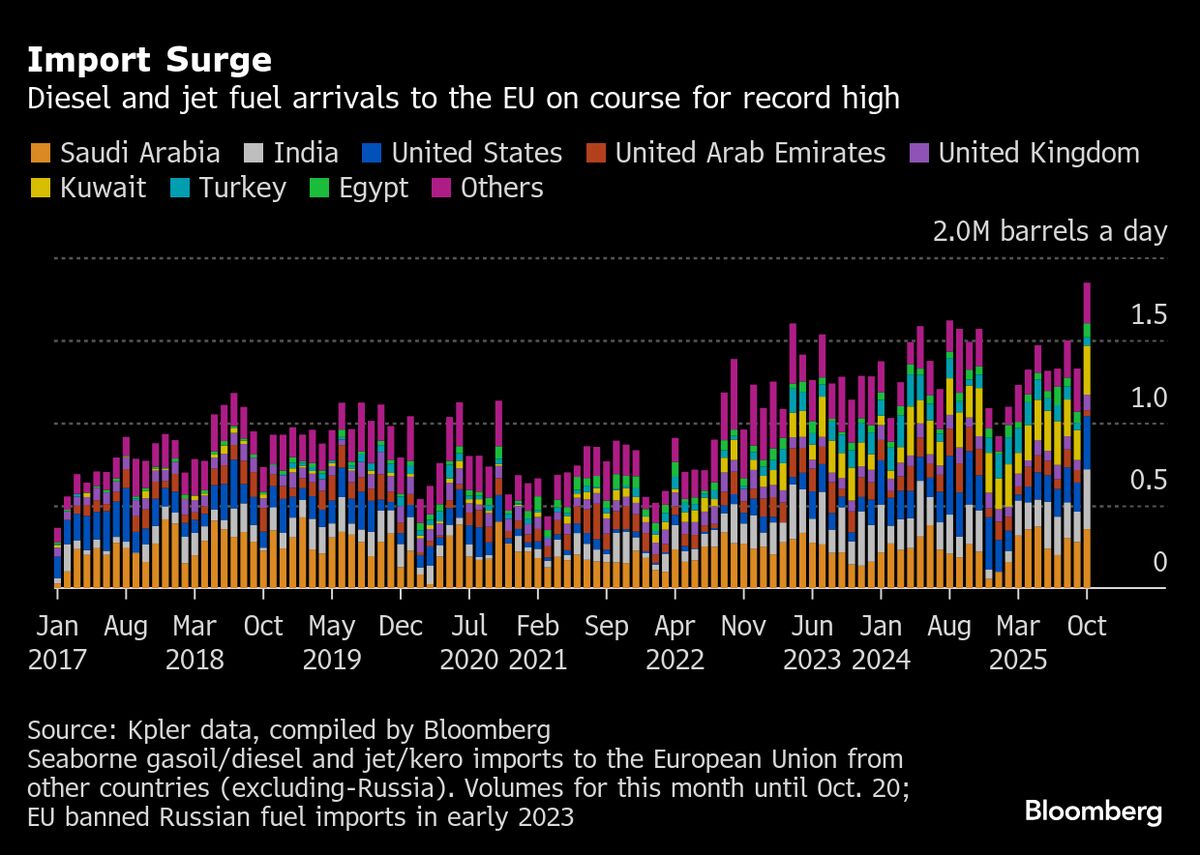

Lukoil, Russia's second-largest oil producer, has announced plans to sell its international assets following the imposition of sanctions by the US. This move highlights the significant impact of geopolitical tensions on major corporations and raises concerns about the future of the oil industry in Russia. As Lukoil navigates these challenges, the implications for global oil markets and energy security are worth watching.

— Curated by the World Pulse Now AI Editorial System