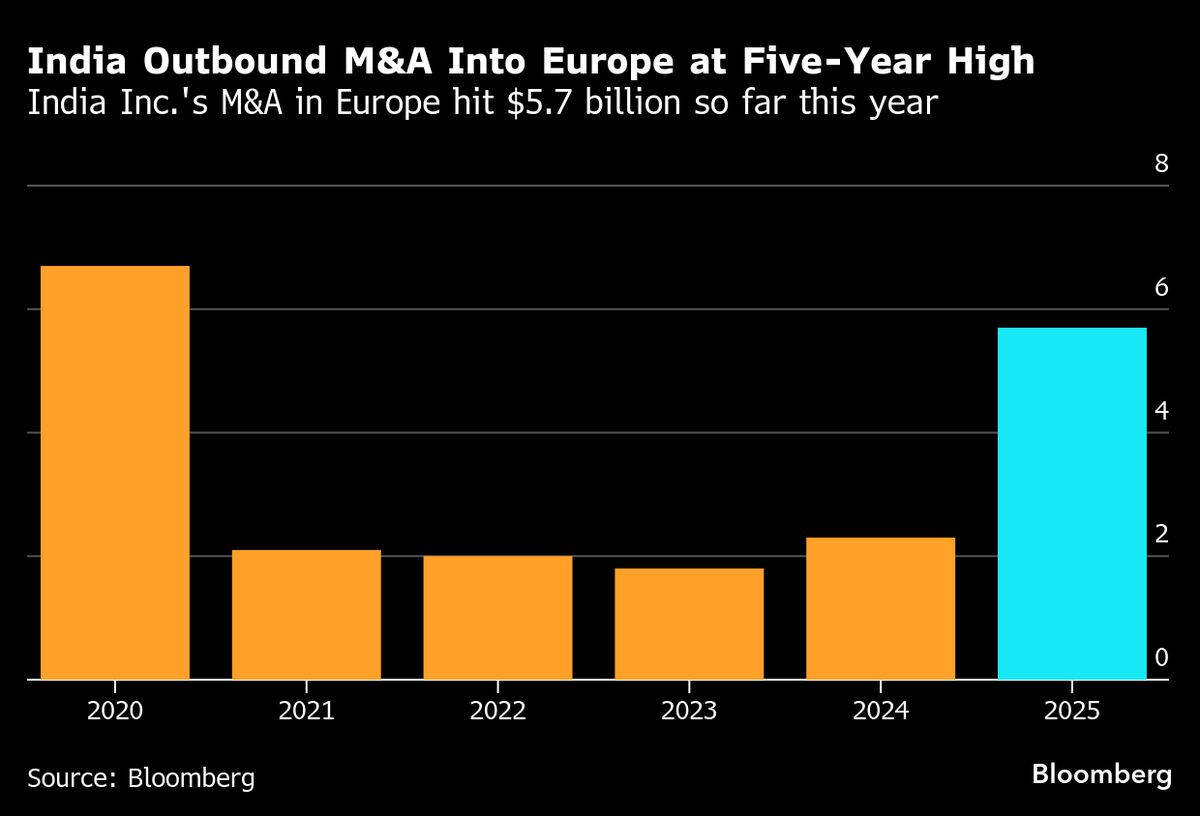

Prized European Assets Up for Grabs as India Inc. Looks Abroad

PositiveFinancial Markets

Indian companies are increasingly eyeing European assets as they seek to expand their global footprint. This trend is significant as it not only allows these firms to acquire valuable resources and expertise but also enhances their competitiveness in the international market. The move reflects a growing confidence among Indian businesses to venture abroad and invest in new opportunities.

— Curated by the World Pulse Now AI Editorial System