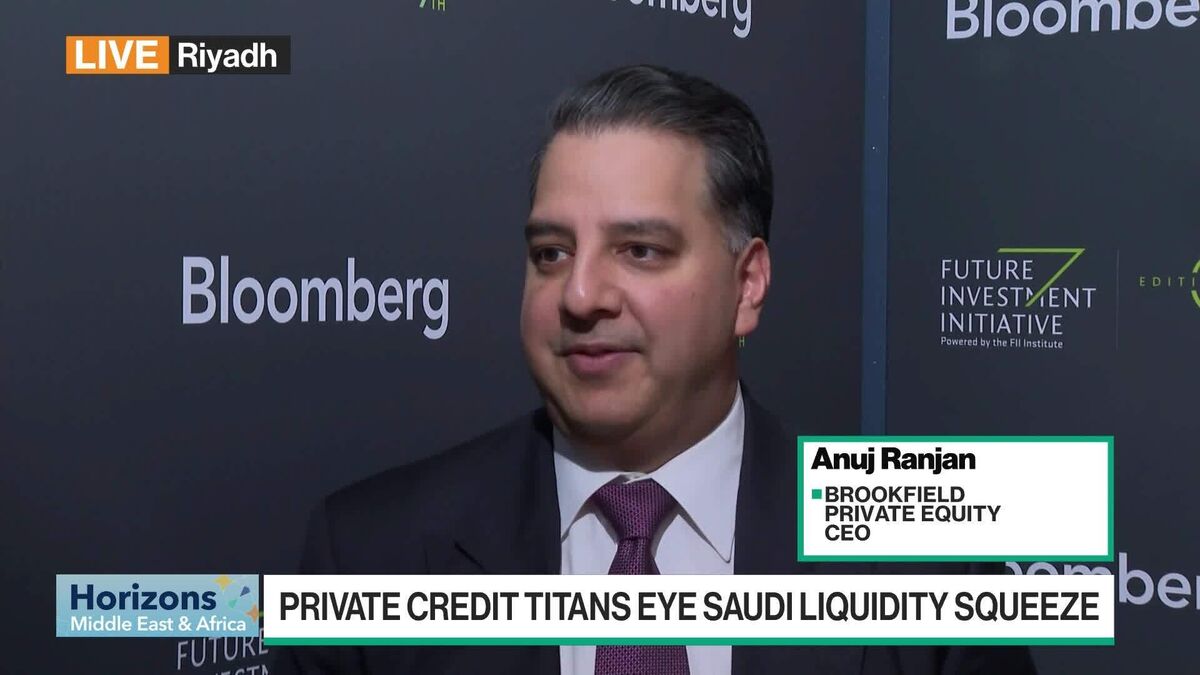

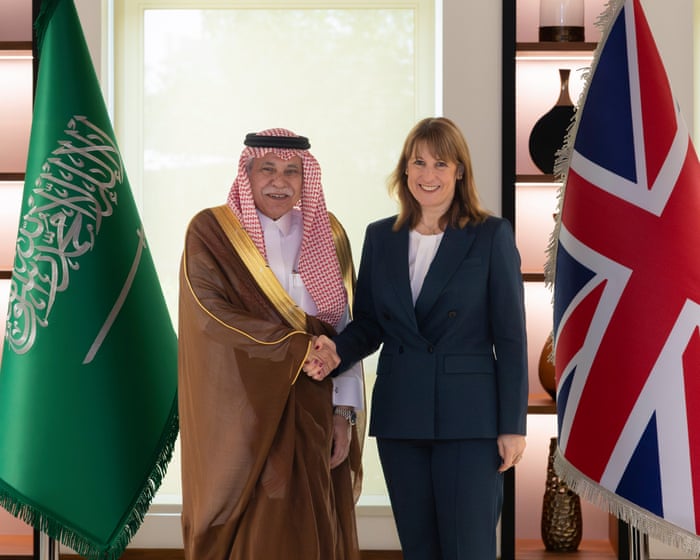

Saudi Wealth Fund’s Boss Touts Vision 2030 Progress Amid Strains

NeutralFinancial Markets

The governor of Saudi Arabia's Public Investment Fund has highlighted the advancements made under the Vision 2030 initiative, despite facing challenges from declining oil prices. This economic overhaul is crucial for the kingdom as it seeks to diversify its economy and reduce dependence on oil revenue, making the progress reported significant for both local and global stakeholders.

— Curated by the World Pulse Now AI Editorial System