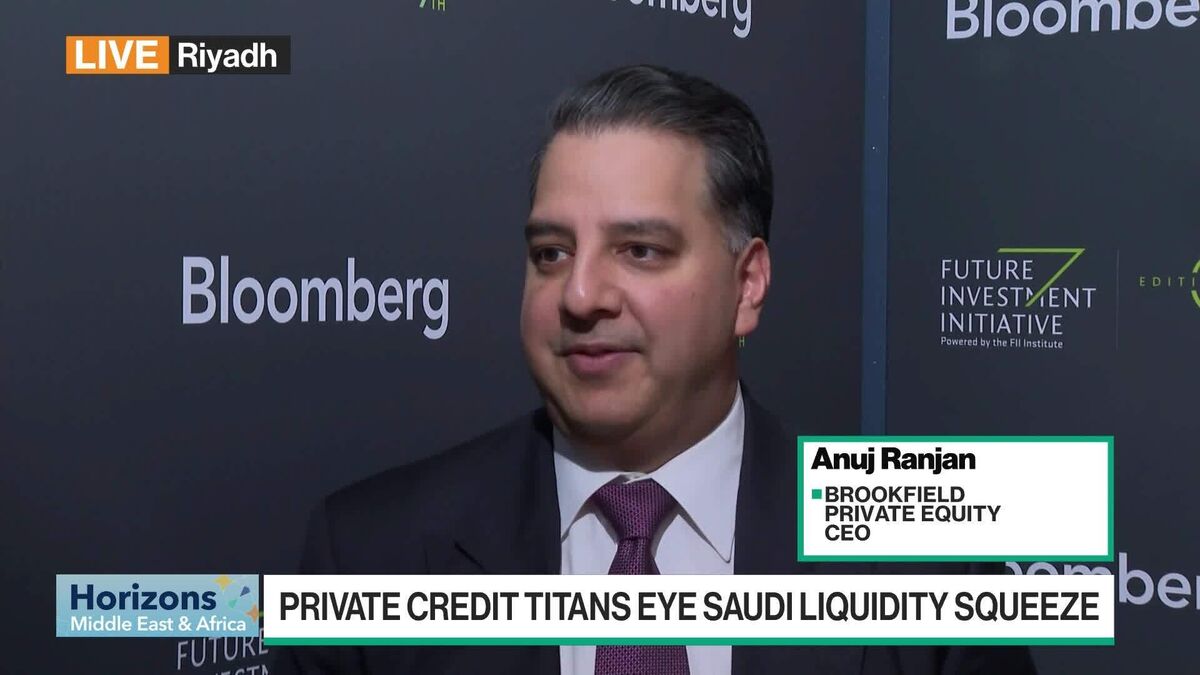

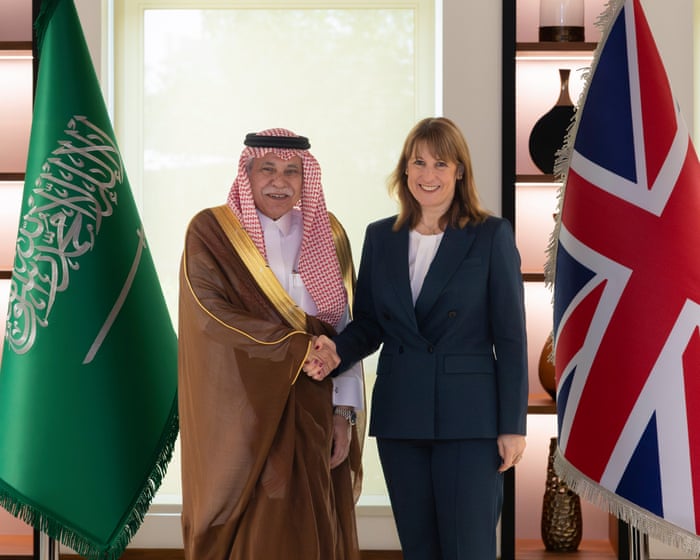

Goldman Joins Peers Deepening Saudi Ties Despite Fiscal Strains

PositiveFinancial Markets

Goldman Sachs is making a bold move to deepen its ties with Saudi Arabia, joining other Wall Street firms in seizing opportunities from the kingdom's economic transformation. This expansion comes even as fiscal challenges loom, highlighting the potential for growth in a rapidly changing market. It's a significant step that reflects confidence in Saudi Arabia's future and could lead to new investment avenues.

— Curated by the World Pulse Now AI Editorial System