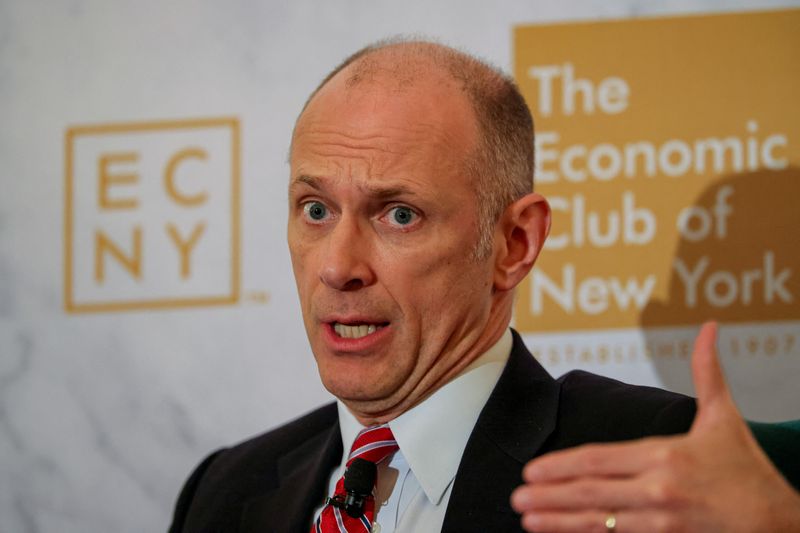

Fed’s Daly backed rate cut, keeps open mind on December decision

PositiveFinancial Markets

In a recent statement, Fed's Daly expressed support for a potential rate cut, indicating a willingness to consider this option in the upcoming December meeting. This is significant as it reflects the Fed's responsiveness to economic conditions and could signal a shift in monetary policy aimed at stimulating growth. Investors and economists are closely watching these developments, as they could impact borrowing costs and overall economic activity.

— Curated by the World Pulse Now AI Editorial System