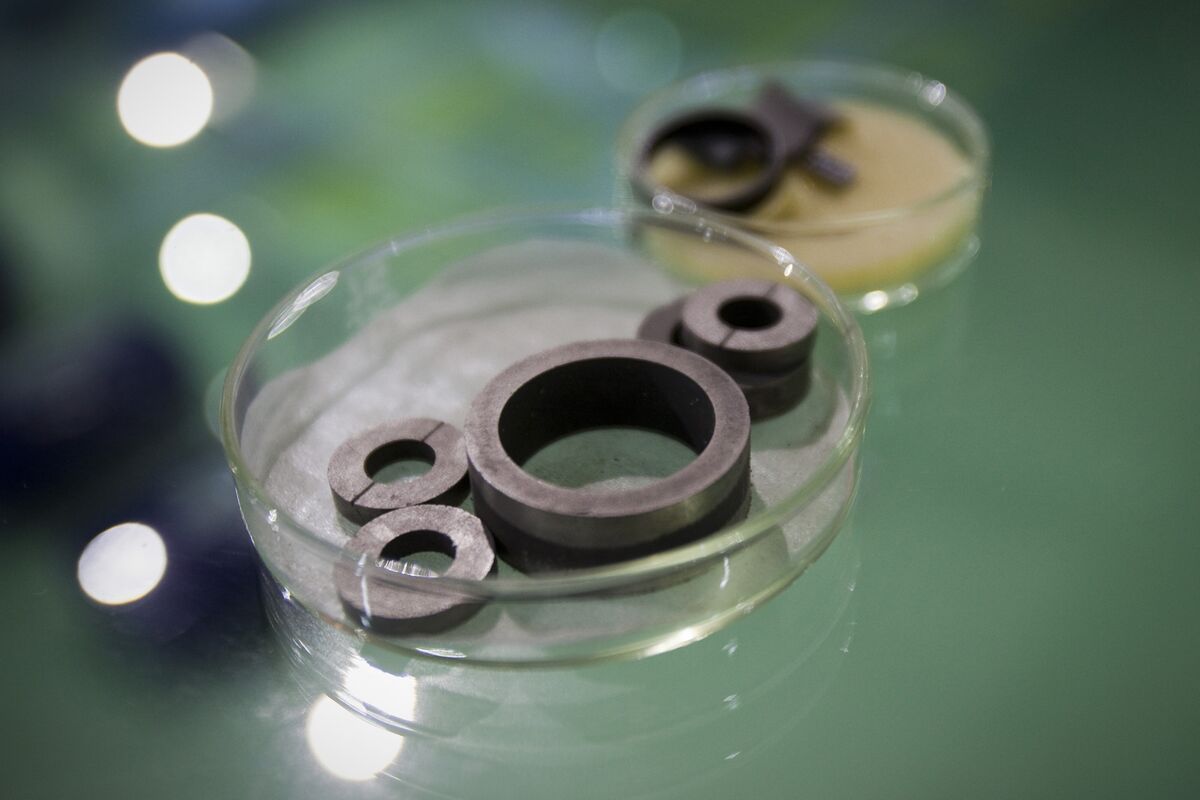

China Started Separating Its Economy From the West Years Ago

NeutralFinancial Markets

China has been gradually distancing its economy from Western influences for several years, a move that reflects its desire for greater self-reliance and control over its economic destiny. This shift is significant as it could reshape global trade dynamics and impact international relations, especially as tensions between China and Western nations continue to rise.

— Curated by the World Pulse Now AI Editorial System