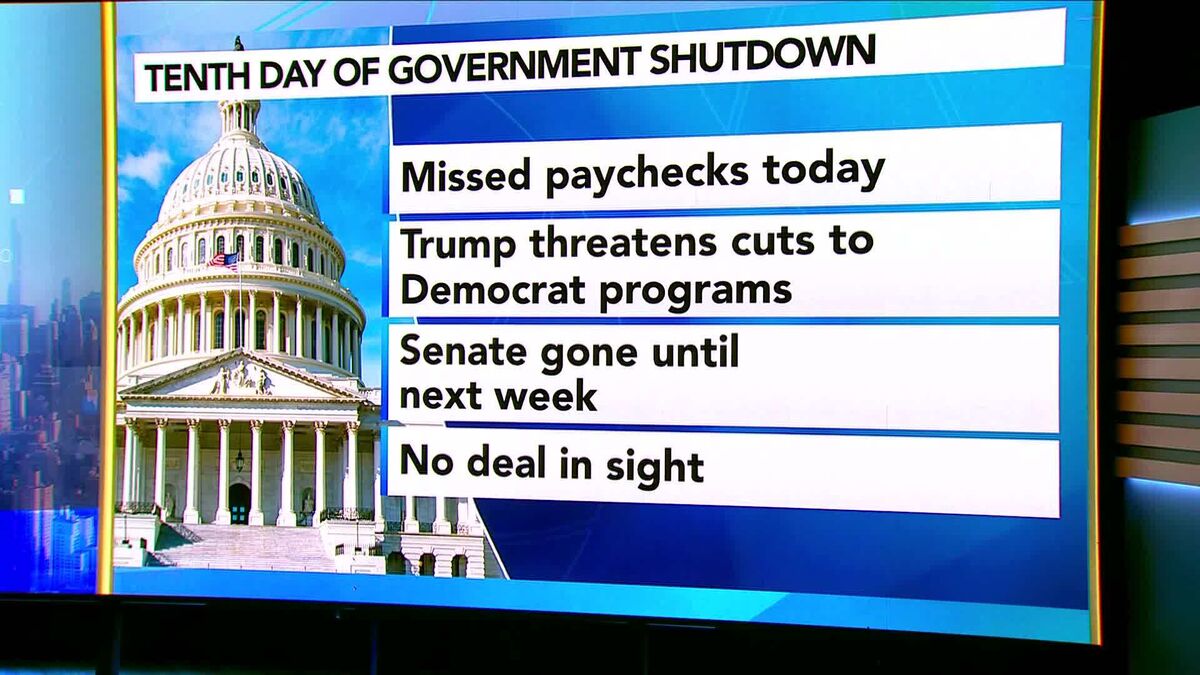

Global selloff underway as traders sour on U.S. government shutdown and doubts about the Fed grow

NegativeFinancial Markets

A global selloff is taking place as traders express concerns over a potential U.S. government shutdown and growing doubts about the Federal Reserve's policies. This situation is significant as it reflects the market's anxiety about economic stability and could lead to broader financial implications.

— Curated by the World Pulse Now AI Editorial System