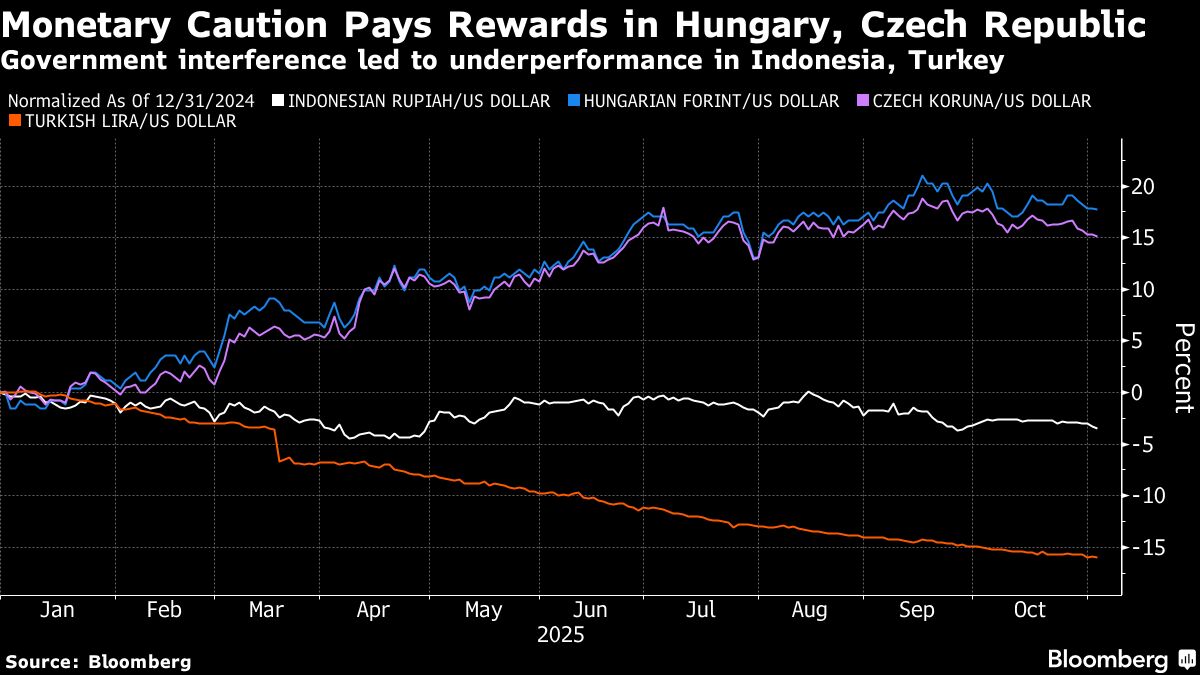

Bets on Eastern Europe Pay Off as Forint, Zloty Surge This Year

PositiveFinancial Markets

Bets on Eastern Europe Pay Off as Forint, Zloty Surge This Year

This year, currencies in Eastern Europe, particularly the forint and zloty, have shown remarkable gains, reflecting traders' confidence in sustained higher interest rates. This surge is significant as it highlights the region's economic resilience and attractiveness to investors, suggesting a positive outlook for Eastern European markets.

— via World Pulse Now AI Editorial System