Trump Real Estate Empire Could Go Onchain Under World Liberty Financial

PositiveCryptocurrency

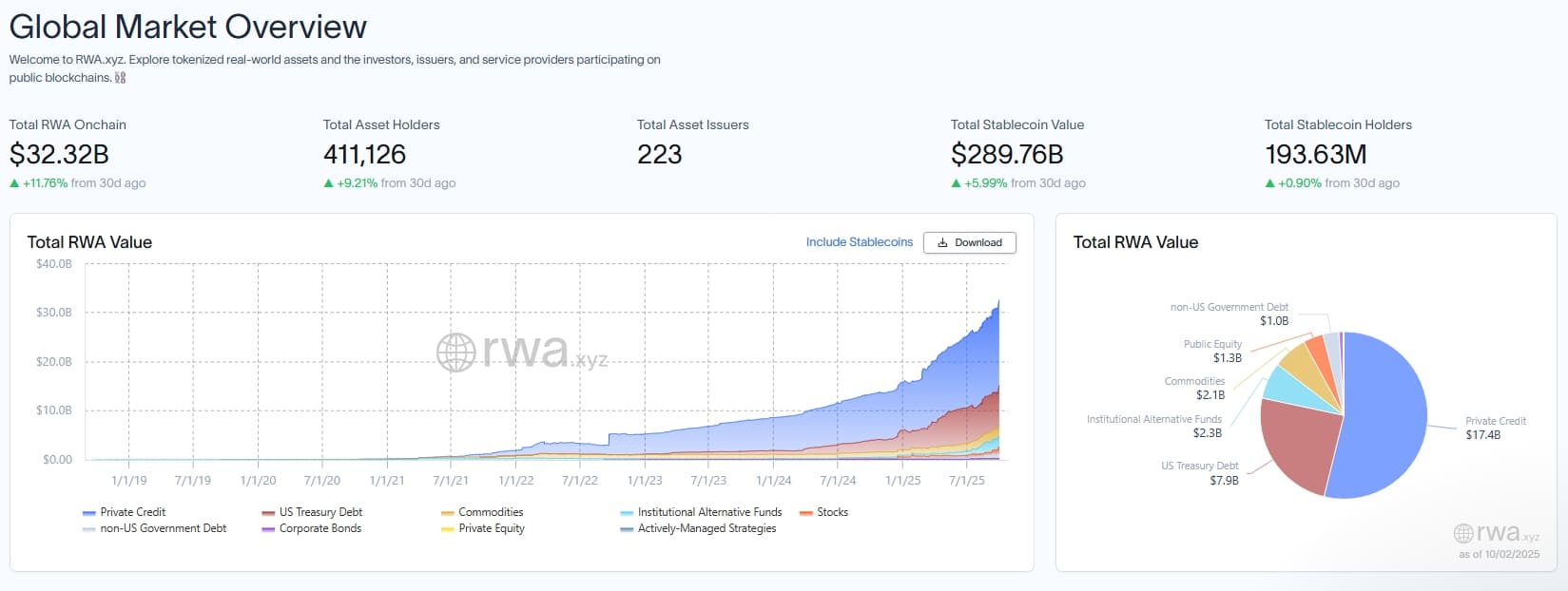

Donald Trump's real estate empire is exploring the possibility of transitioning to blockchain technology through World Liberty Financial. This move could revolutionize how real estate transactions are conducted, making them more transparent and efficient. By leveraging blockchain, Trump's properties could attract a new wave of investors interested in innovative financial solutions, potentially enhancing the value and accessibility of his real estate portfolio.

— Curated by the World Pulse Now AI Editorial System