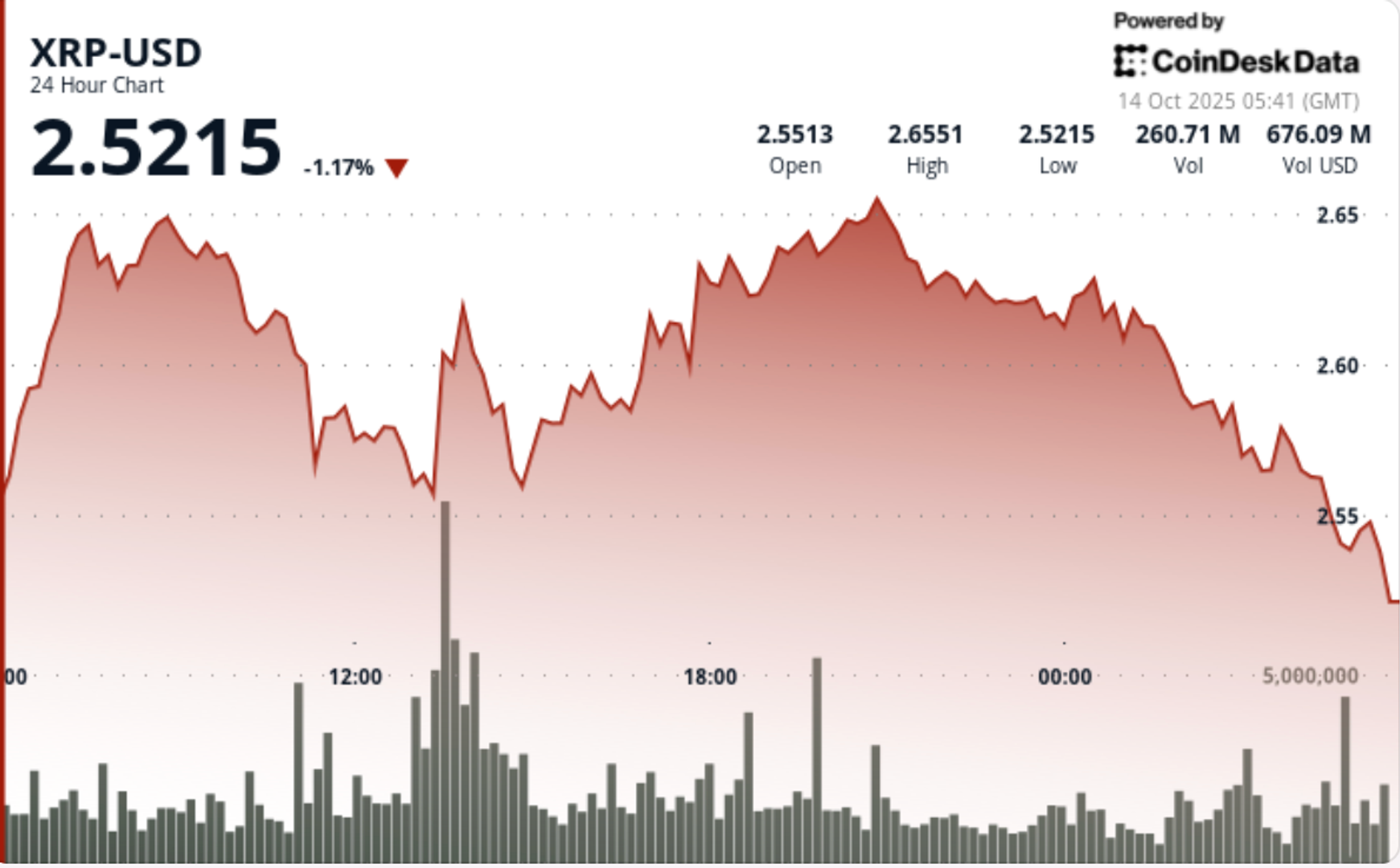

Grayscale Updates XRP ETF Filing—GXRP Aims for NYSE Arca as Institutional Demand Accelerates

PositiveCryptocurrency

Grayscale has made significant updates to its XRP ETF filing, aiming to list the GXRP on NYSE Arca as institutional demand for cryptocurrency investments continues to rise. This move is crucial as it reflects growing confidence in the crypto market and could pave the way for more institutional players to enter, potentially stabilizing and boosting the market further.

— Curated by the World Pulse Now AI Editorial System