Bitcoin’s Deep Correction Sets Stage for December Rebound, Says K33 Research

NeutralCryptocurrency

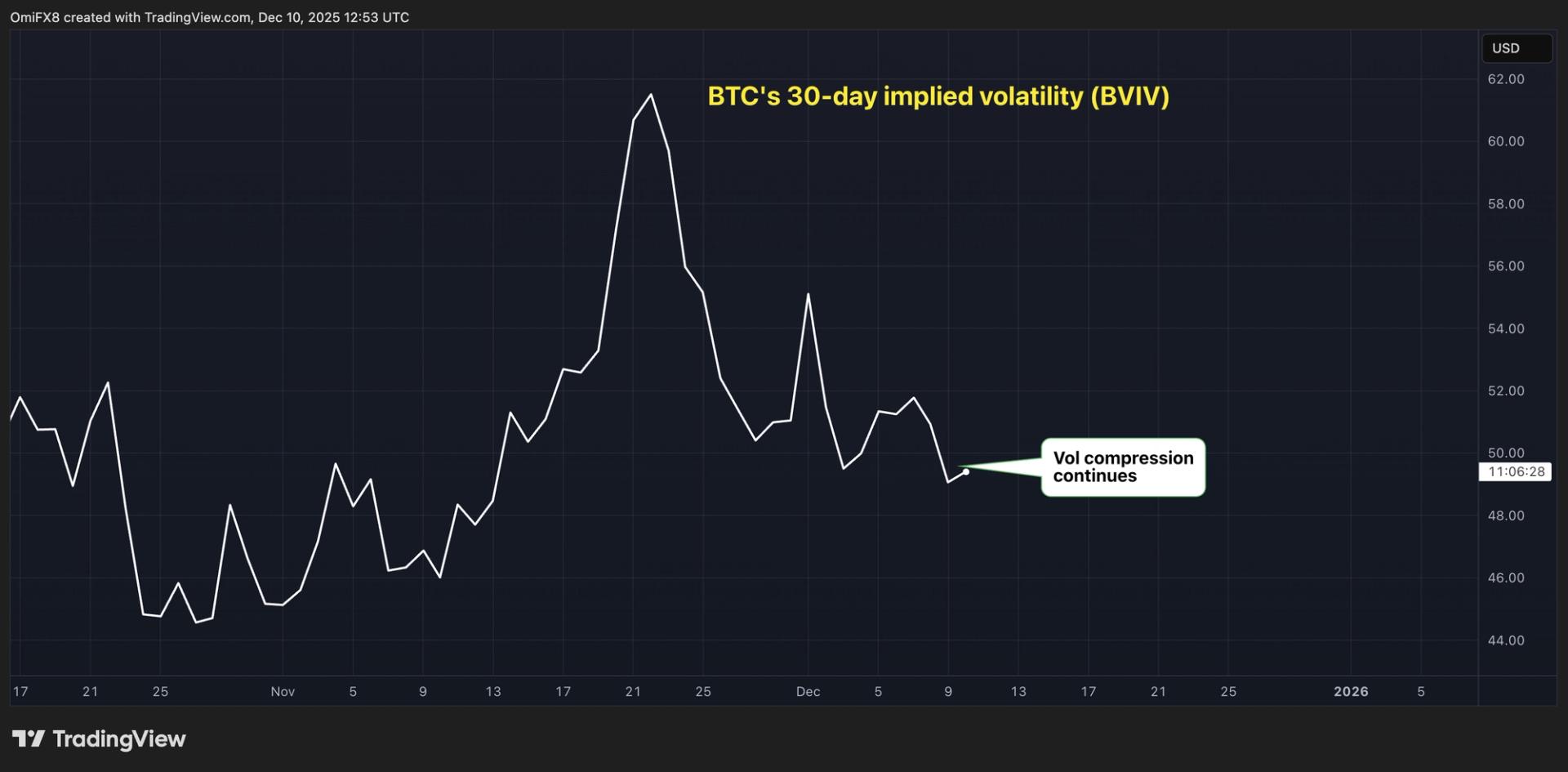

- Bitcoin is experiencing a significant correction, with K33 Research indicating that market fear is currently overshadowing fundamental factors as the cryptocurrency approaches critical price levels. This situation suggests that December may present an opportunity for investors willing to take risks.

- The current market dynamics are crucial for Bitcoin, as the potential for a rebound in December could attract bold investors looking for entry points amidst the ongoing volatility. The sentiment surrounding Bitcoin's price movements is pivotal for its recovery.

- The broader cryptocurrency market is facing mixed signals, with some analysts predicting a continued decline while others see potential for recovery. Concerns about Bitcoin dropping to lower price thresholds, such as $80,000, are prevalent, reflecting a cautious outlook among investors. This uncertainty highlights the ongoing debates regarding market trends and investor confidence in the cryptocurrency sector.

— via World Pulse Now AI Editorial System