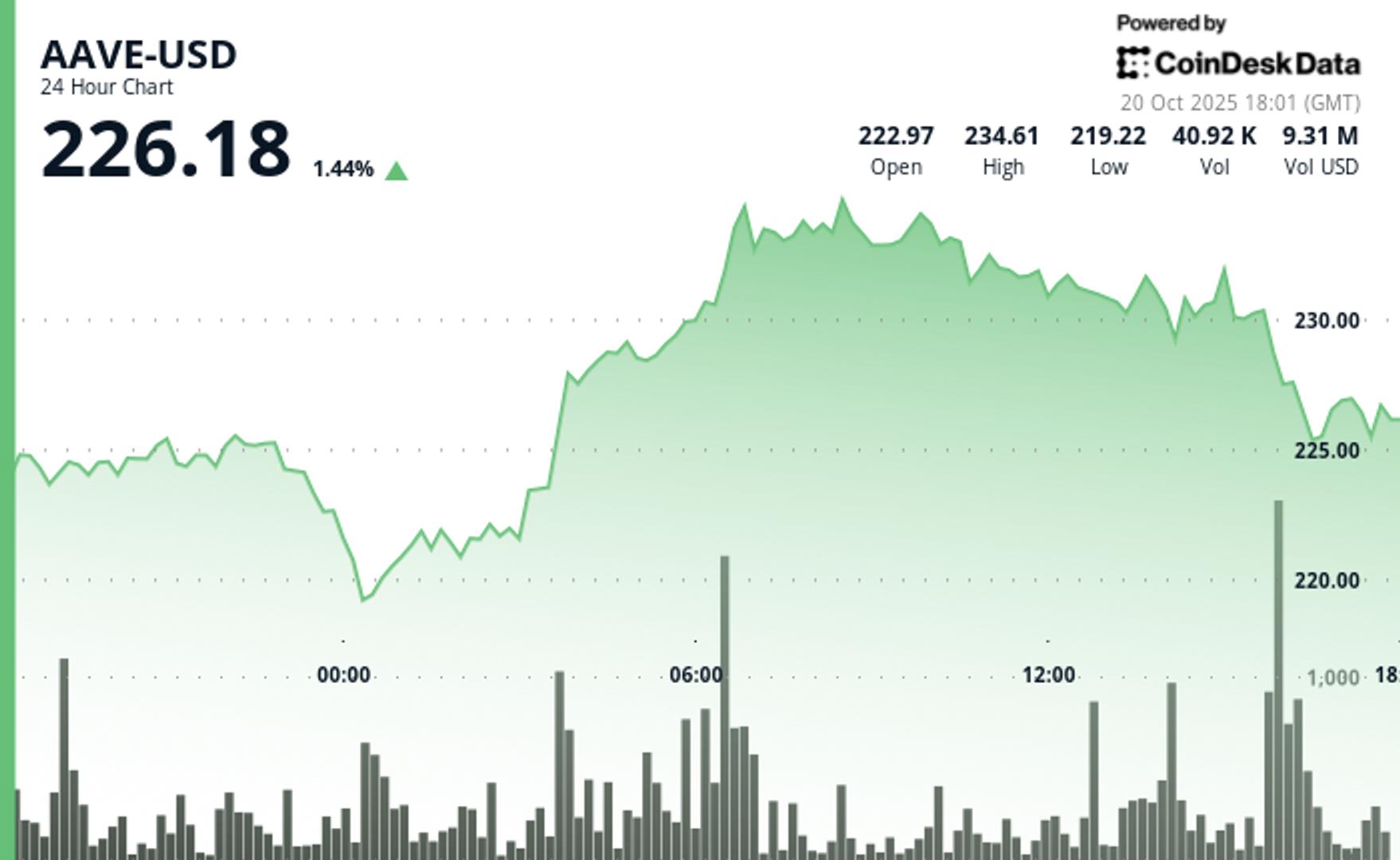

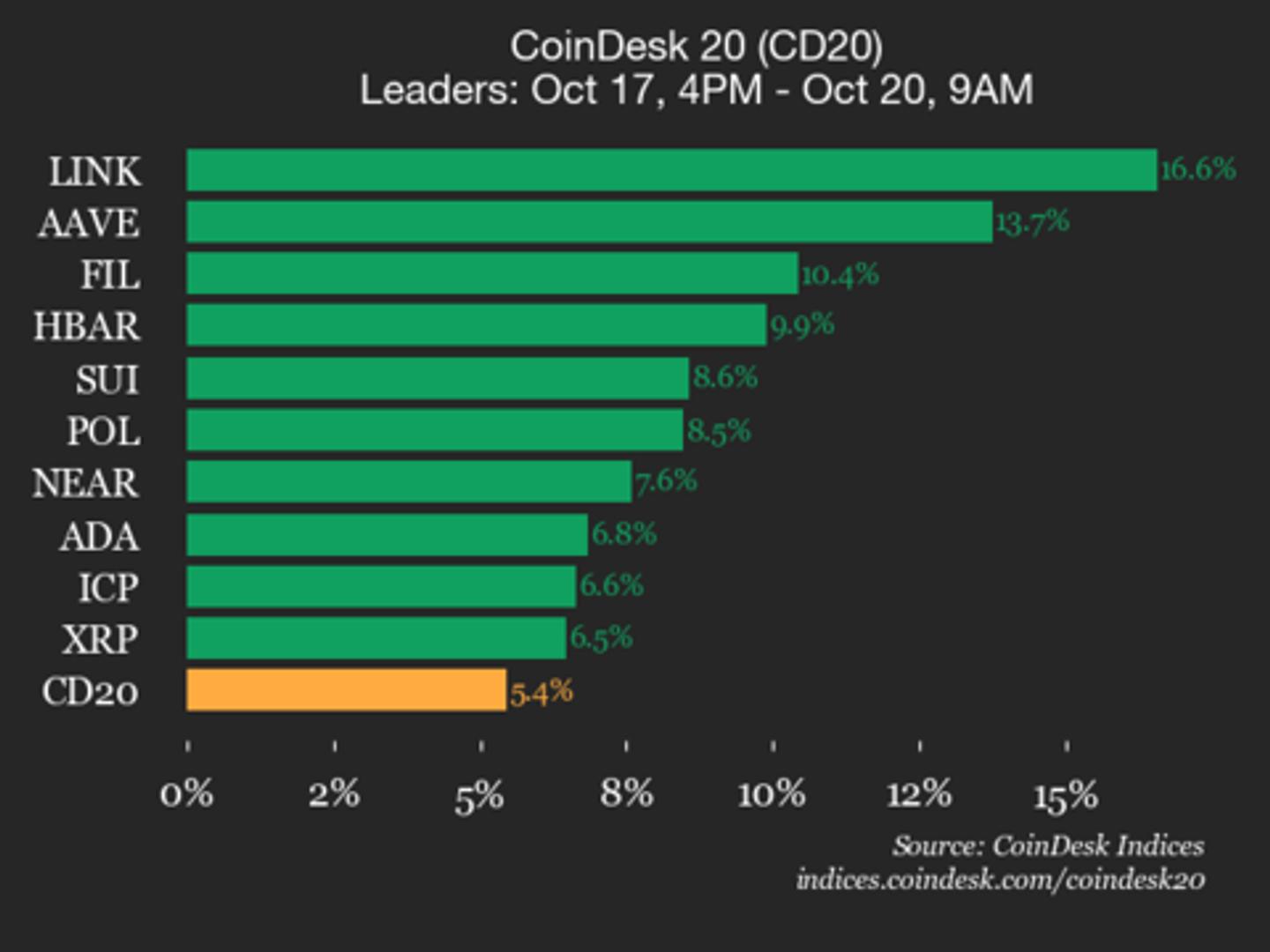

Maple and Aave bring institutional credit to DeFi lending

PositiveCryptocurrency

Aave is making waves in the DeFi space by partnering with Maple to introduce structured-yield tokens backed by real-world assets. This collaboration comes at a time when institutional interest in decentralized finance is on the rise, signaling a significant shift in how traditional finance and DeFi can intersect. By bringing institutional credit to the forefront of DeFi lending, this partnership not only enhances the offerings available to users but also paves the way for more robust financial products in the future.

— Curated by the World Pulse Now AI Editorial System