Worldcoin Faces New Regulatory Pressure as Thai Authorities Raid Iris-Scanning Site

NegativeCryptocurrency

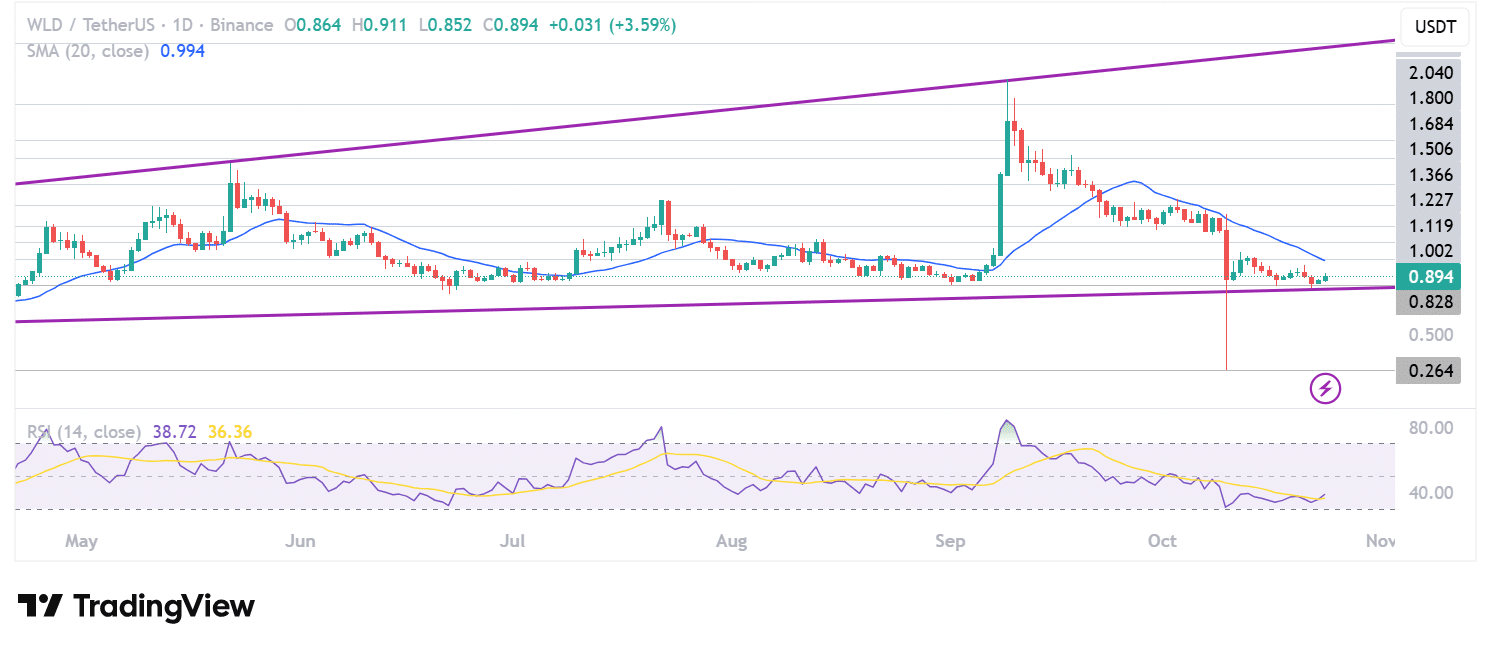

Worldcoin, the ambitious project led by Sam Altman, is facing significant regulatory challenges in Thailand after authorities raided an iris-scanning site in Bangkok. This action by the national Securities and Exchange Commission and the Cyber Crime Investigation Bureau raises concerns about the project's compliance and could impact its future operations and the value of its cryptocurrency, WLD. As regulatory scrutiny intensifies, it highlights the ongoing tension between innovative tech projects and government oversight, making it a critical moment for Worldcoin and its stakeholders.

— Curated by the World Pulse Now AI Editorial System