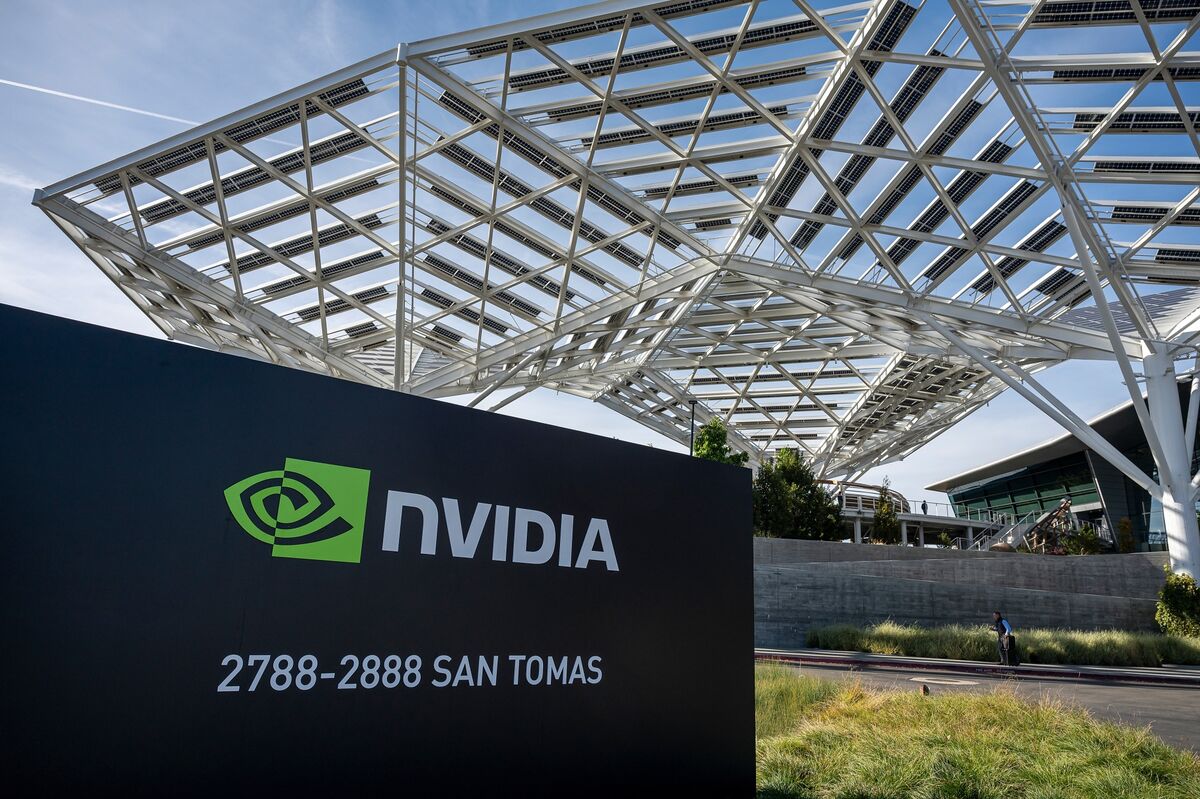

US Stocks Erase Gains Amid Resurfacing AI, Valuation Worries

NegativeFinancial Markets

- The S&P 500 Index has declined, reversing previous gains amid resurfacing worries about AI investments and elevated market valuations, indicating a potential shift in investor sentiment.

- This decline is significant as it highlights the fragility of the market, particularly in the tech sector, where valuations have been under scrutiny, raising alarms about a possible correction.

- Broader market trends suggest that fears surrounding AI valuations are influencing not only stock prices but also credit markets, as investors grapple with the implications of a potential downturn.

— via World Pulse Now AI Editorial System