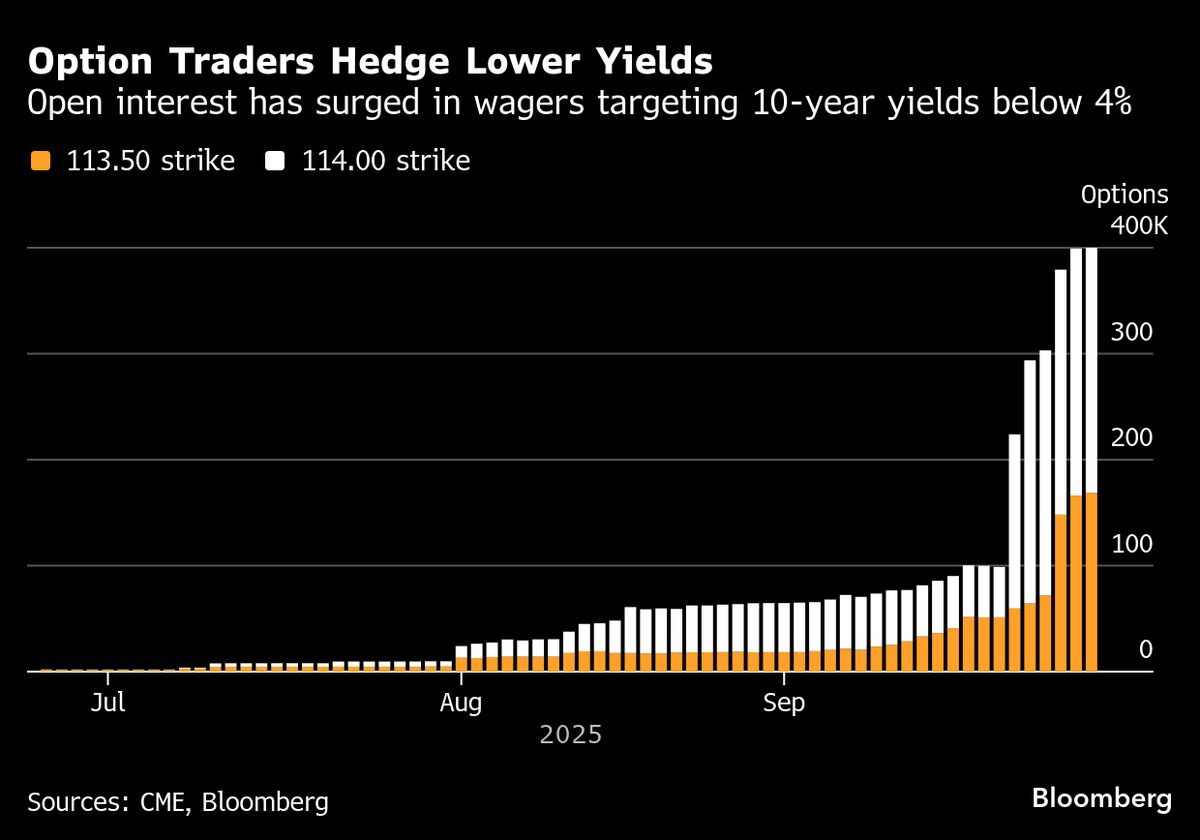

Bond Traders Dare to Go Longer Before 4% Yield Disappears

PositiveFinancial Markets

Bond traders are feeling optimistic as they navigate a year of significant gains, thanks to the Federal Reserve's interest-rate cuts and declining short-term US yields. This trend is crucial as it indicates a shift in market dynamics, allowing investors to capitalize on longer-term bonds before yields potentially rise again.

— Curated by the World Pulse Now AI Editorial System