Stocks Flat on Strong Jobs Data, Meta Soars on Budget Cuts

NeutralFinancial Markets

- US stocks experienced small gains on Thursday, buoyed by stronger

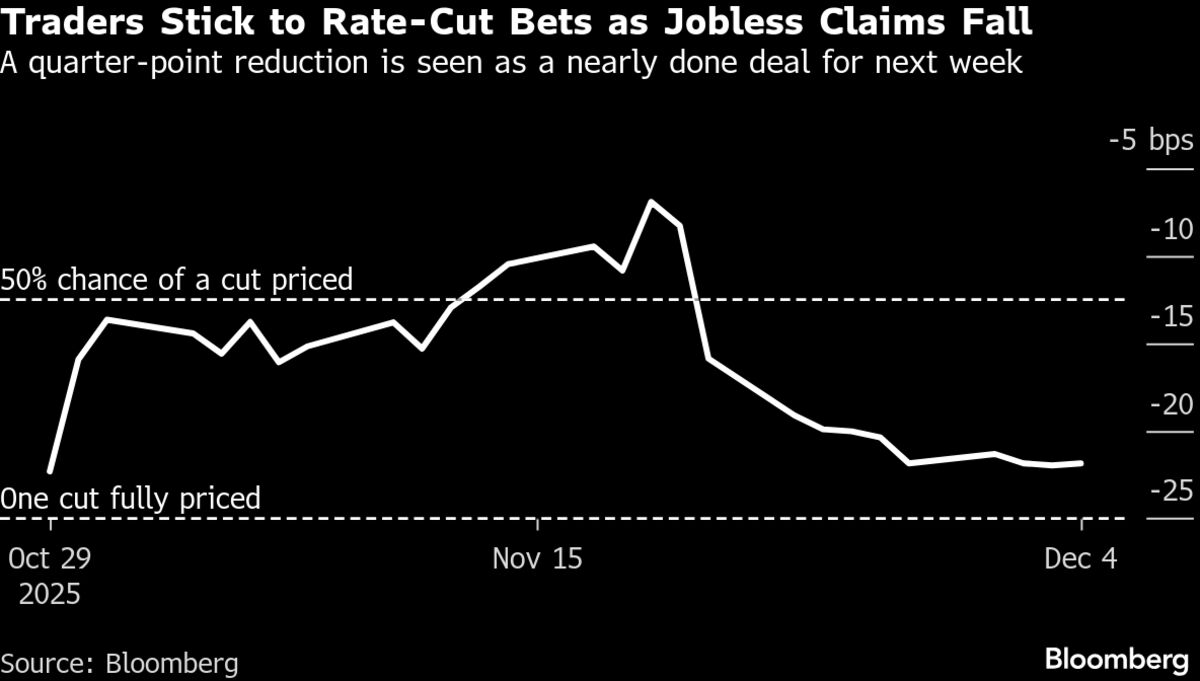

- The strong jobs data indicates resilience in the labor market, yet it has not shifted the Federal Reserve's anticipated monetary policy, which remains focused on potential rate cuts. This situation highlights the delicate balance the Fed must maintain in fostering economic growth while managing inflation.

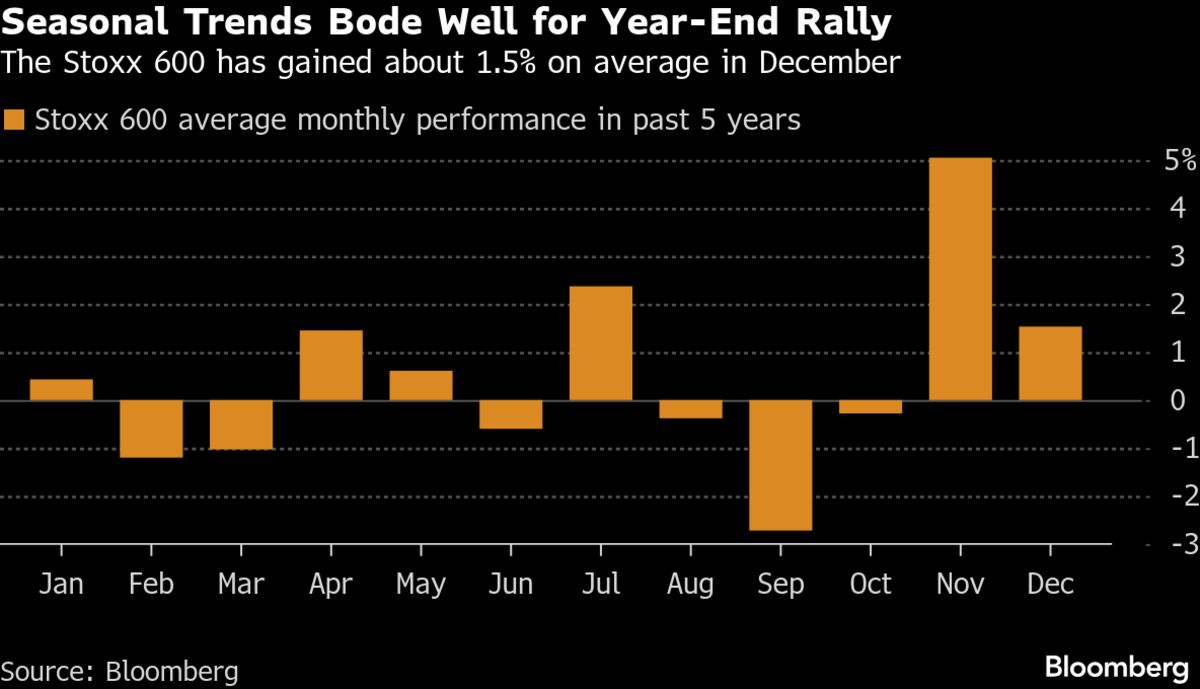

- The broader market sentiment is influenced by ongoing discussions about interest rate adjustments, with various sectors reacting differently to economic indicators. Recent trends show a growing optimism among investors regarding potential rate cuts, as evidenced by rising stock prices and increased activity in tech stocks, suggesting a shift in market dynamics as stakeholders adjust their strategies.

— via World Pulse Now AI Editorial System