Bessent Under Discussion to Also Lead NEC | Bloomberg Brief 12/4/2025

NeutralFinancial Markets

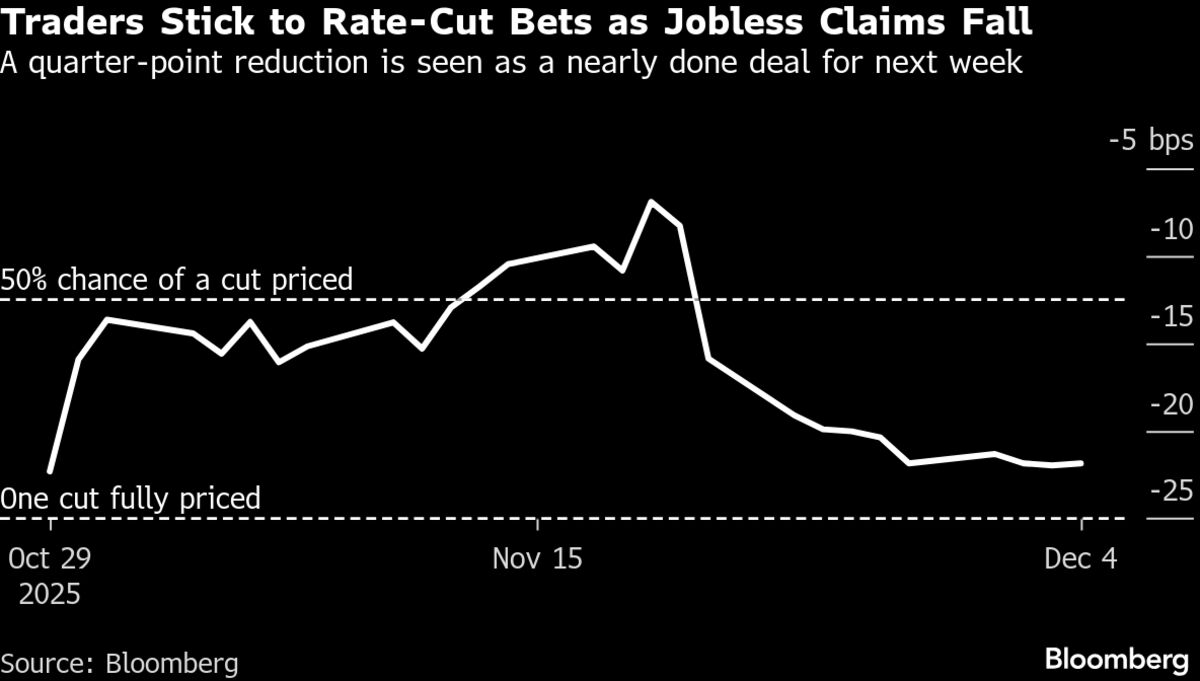

- US equity futures are maintaining gains as discussions arise regarding Treasury Secretary Scott Bessent potentially leading the National Economic Council alongside his current role, contingent on President Trump's expected nomination of Kevin Hassett as the next Federal Reserve chair. This development comes amid ongoing labor market data analysis.

- The consideration of Bessent for a dual role reflects the administration's strategy to consolidate economic leadership, which could streamline decision-making processes in economic policy amid rising consumer concerns over inflation and interest rates.

- This situation highlights the pressures Bessent faces from President Trump to deliver a compliant candidate for the Federal Reserve chair, as well as the broader implications of Hassett's potential nomination on U.S. monetary policy, particularly in the context of Trump's push for lower interest rates and the administration's economic agenda.

— via World Pulse Now AI Editorial System