US government credit default swap spreads edge higher

NegativeFinancial Markets

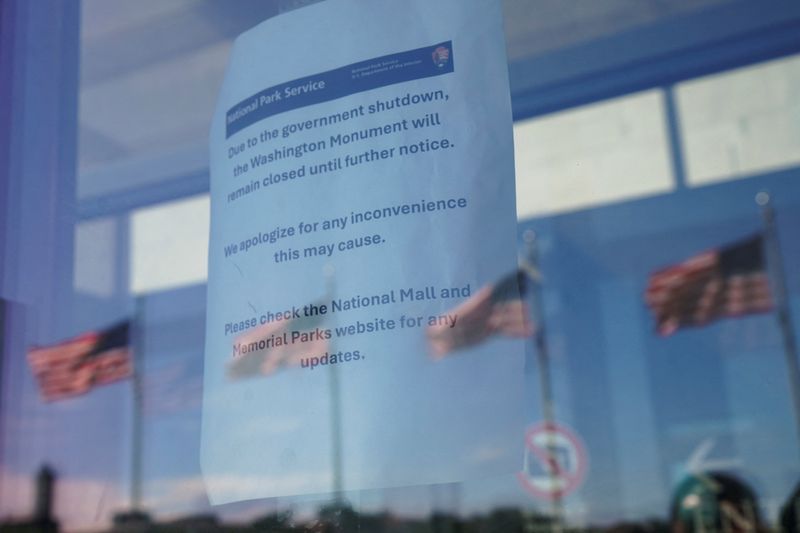

The recent rise in US government credit default swap spreads indicates growing concerns among investors about the country's financial stability. This shift reflects a cautious sentiment in the financial markets, as higher spreads suggest that investors are increasingly worried about the risk of default. Understanding these trends is crucial, as they can impact borrowing costs and overall economic confidence.

— Curated by the World Pulse Now AI Editorial System