Macron warns EU may hit China with tariffs over trade surplus

NegativeFinancial Markets

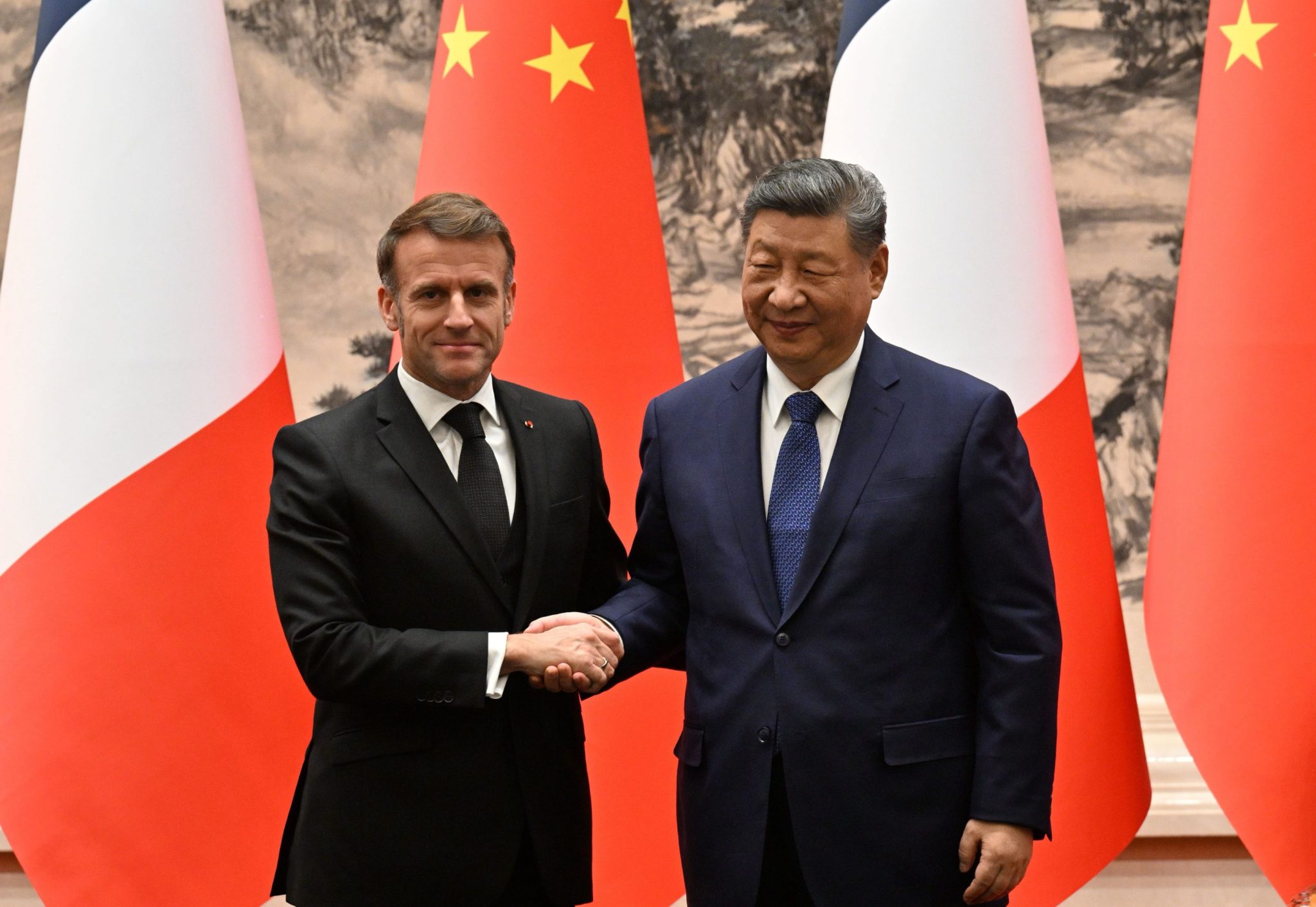

- French President Emmanuel Macron has warned that the European Union (EU) may impose tariffs on China due to a significant trade surplus, criticizing the US approach to China as detrimental to Europe's market position. He noted that the US strategy has redirected Chinese goods towards the EU, exacerbating the trade imbalance.

- This warning is crucial as it highlights the EU's growing concerns over its trade dynamics with China, particularly in light of increasing competition and reliance on Chinese imports, which could threaten European industries.

- The situation reflects broader economic tensions, as the EU grapples with its dependency on Chinese goods while also facing pressures from the US regarding trade policies. The call for tariffs underscores a potential shift towards protectionist measures within the EU, aiming to safeguard its market from external economic threats.

— via World Pulse Now AI Editorial System