European CEOs downbeat on Europe, favour US investment, survey shows

NegativeFinancial Markets

- A recent survey indicates that European CEOs are increasingly pessimistic about the economic outlook in Europe, showing a preference for investing in the US instead. This sentiment reflects a broader trend of declining confidence among business leaders in the region, as they navigate a challenging economic environment.

- The shift in investment focus from Europe to the US is significant for European businesses, as it may lead to reduced capital inflows and hinder economic growth. This trend could exacerbate existing economic challenges and impact job creation within Europe.

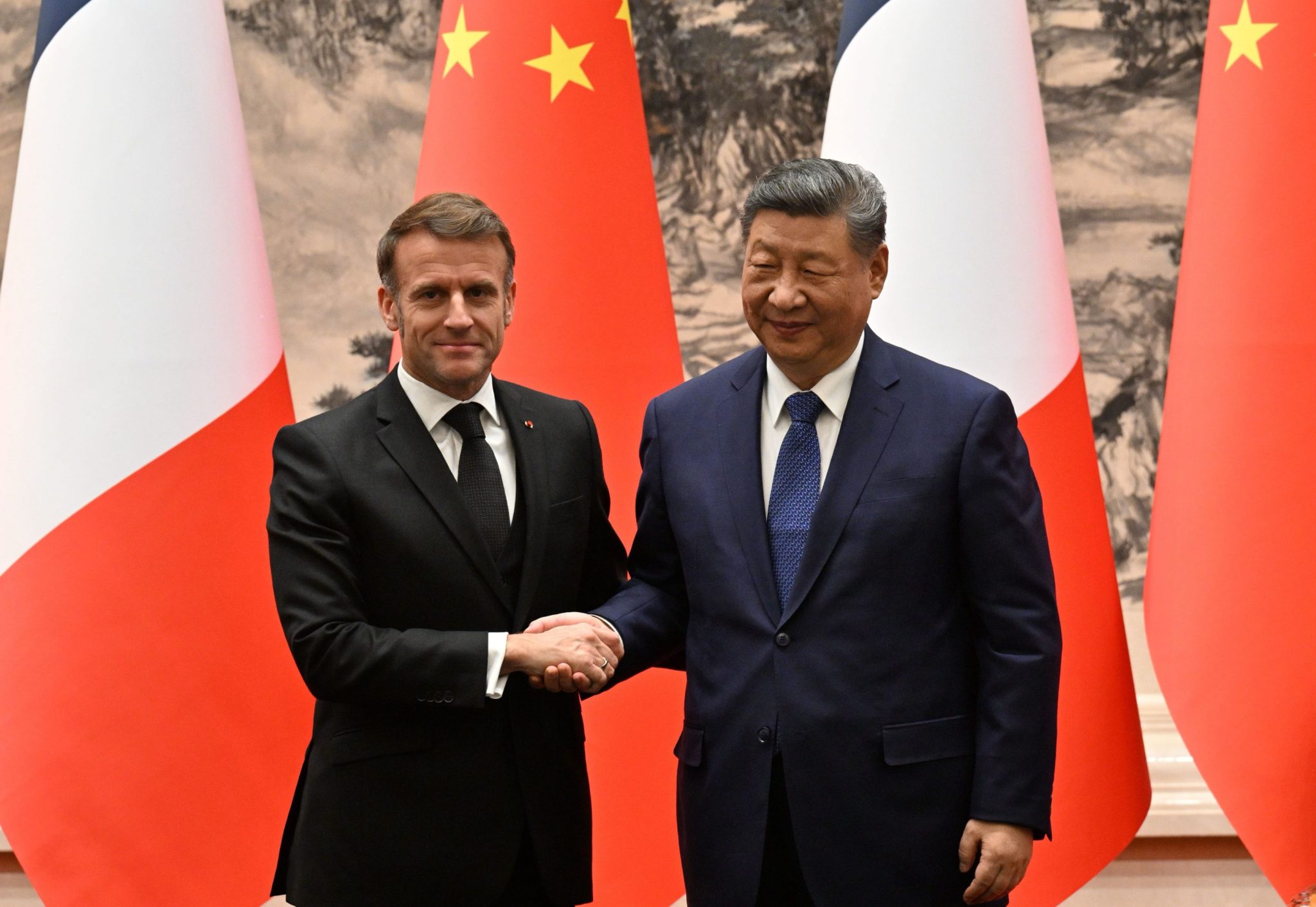

- This development occurs against a backdrop of rising tensions in international trade, with European leaders expressing concerns over the US's approach to China and its implications for Europe’s market position. Additionally, the recent downturn in European stock performance and public discontent regarding trade agreements with the US further highlight the complexities facing European economies.

— via World Pulse Now AI Editorial System