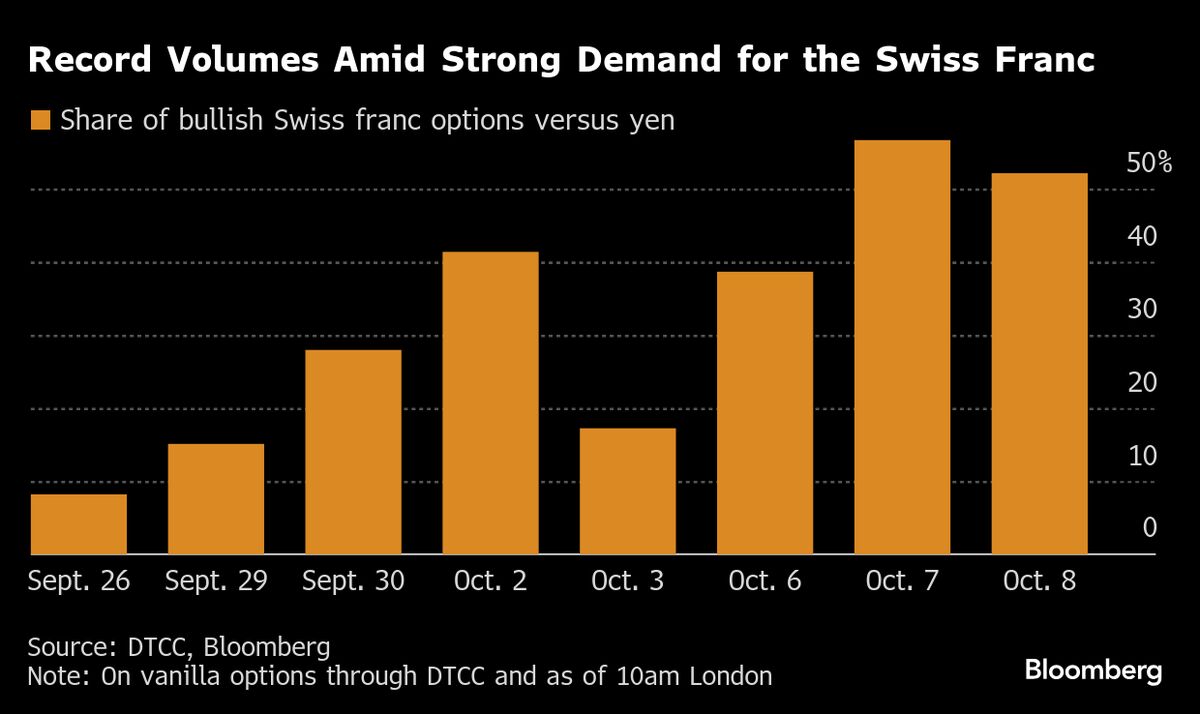

A Week of Records for Swiss Franc Versus Yen Doesn’t Deter Bulls

PositiveFinancial Markets

This week has been remarkable for the Swiss franc, which has set a record against the yen every single day. Despite these impressive gains, traders remain optimistic and are continuing to bet on further increases. This trend highlights the strength of the Swiss currency and reflects confidence in its future performance, making it a key focus for investors.

— Curated by the World Pulse Now AI Editorial System