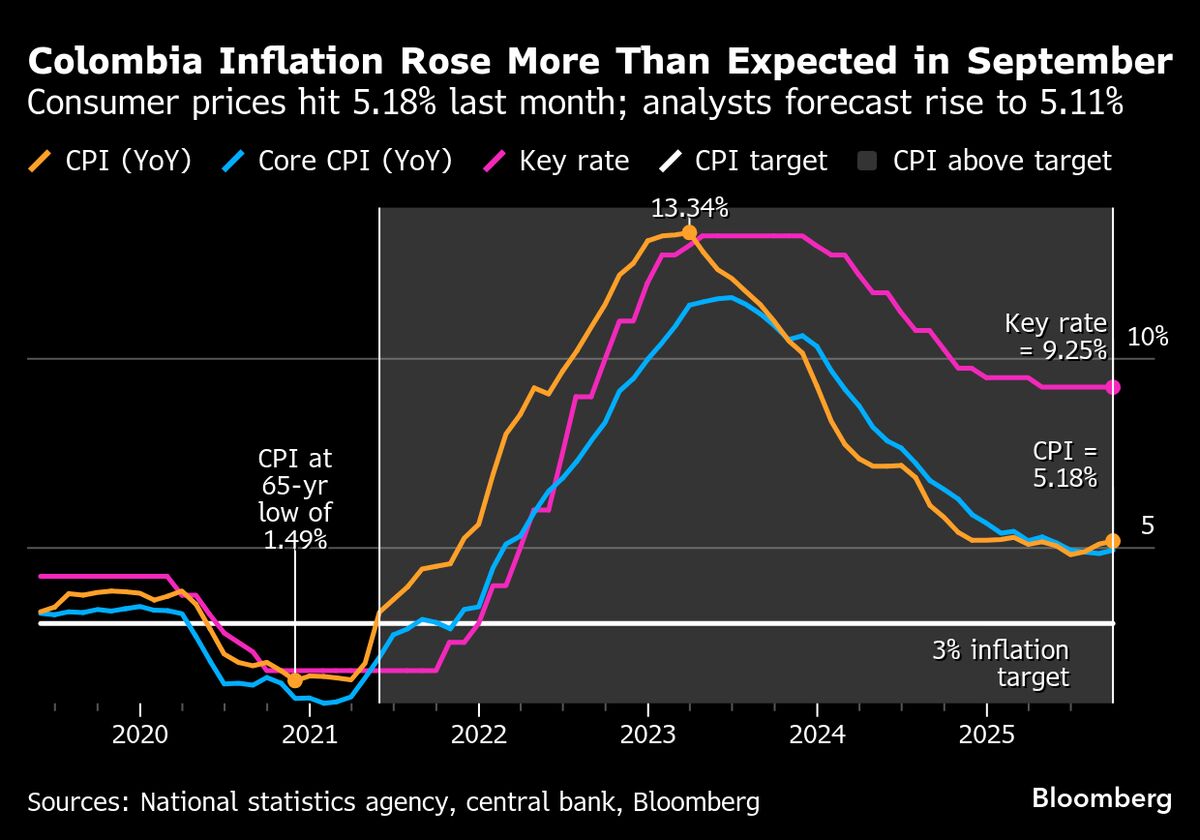

Colombia Inflation Outpaces Forecasts, Jumps to Seven-Month High

NegativeFinancial Markets

Colombia's inflation has surged to a seven-month high, which is concerning for the economy and highlights the challenges faced by the central bank. This rise in inflation strengthens the position of board members who are pushing back against political pressure to lower interest rates, indicating a potential struggle between economic stability and political influence. Understanding these dynamics is crucial as they can impact everything from consumer prices to investment decisions.

— Curated by the World Pulse Now AI Editorial System