Stock Market Today: 10-year yield under 4%; stocks slump

NegativeFinancial Markets

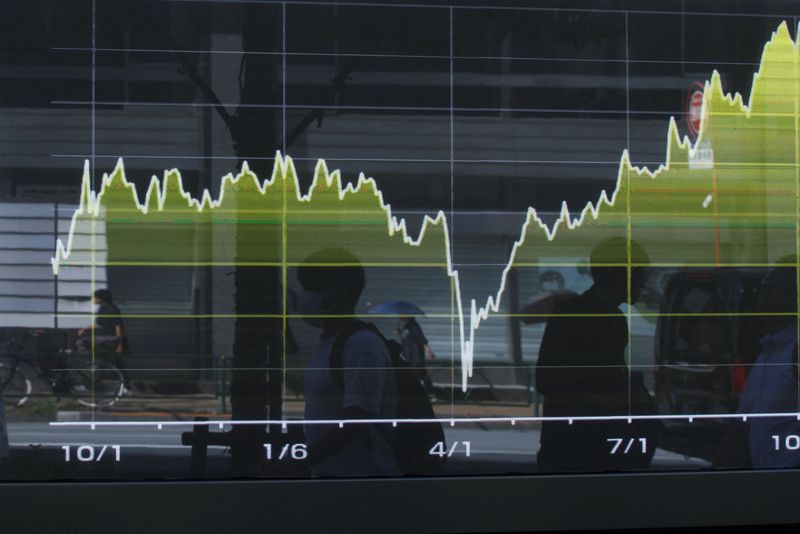

Today, the stock market faced a downturn as the yield on the 10-year U.S. note dropped below 4% for the first time since October 2024. While this might seem like a positive sign, it actually indicates investor anxiety, leading to a sell-off in stocks as people rush to buy safer bonds. The Standard & Poor's 500 Index closed lower, reflecting a broader trend of uncertainty in the market. This shift is significant as it highlights the ongoing volatility and changing investor sentiment, which could have implications for economic stability.

— Curated by the World Pulse Now AI Editorial System