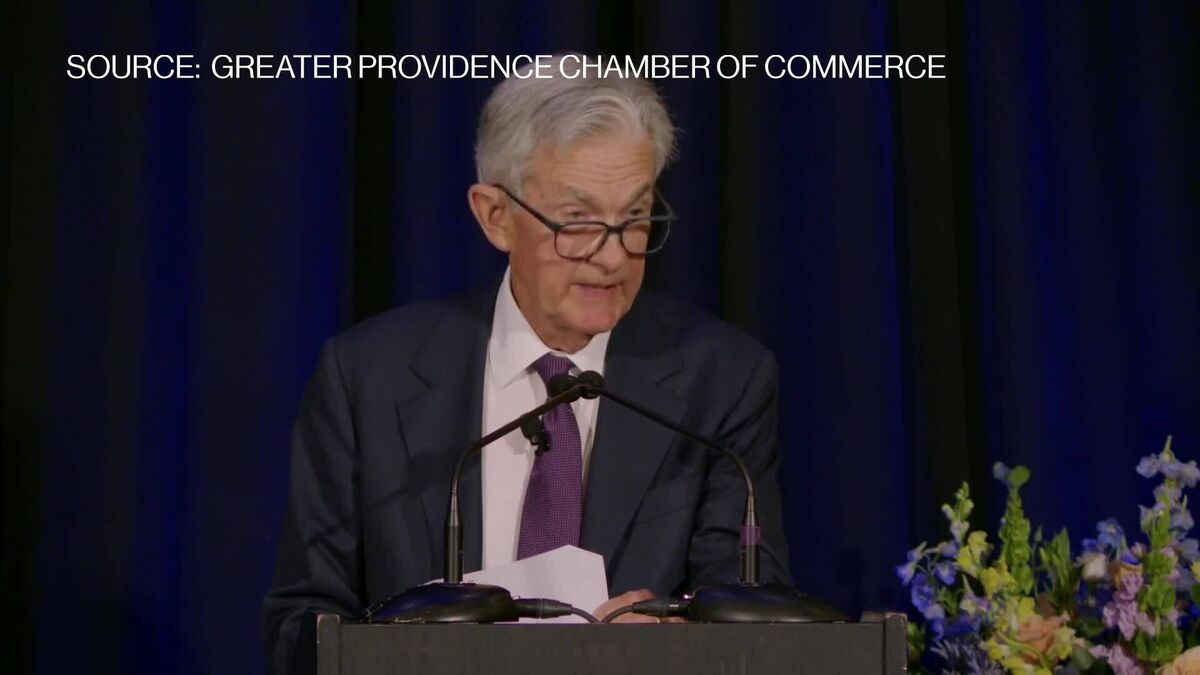

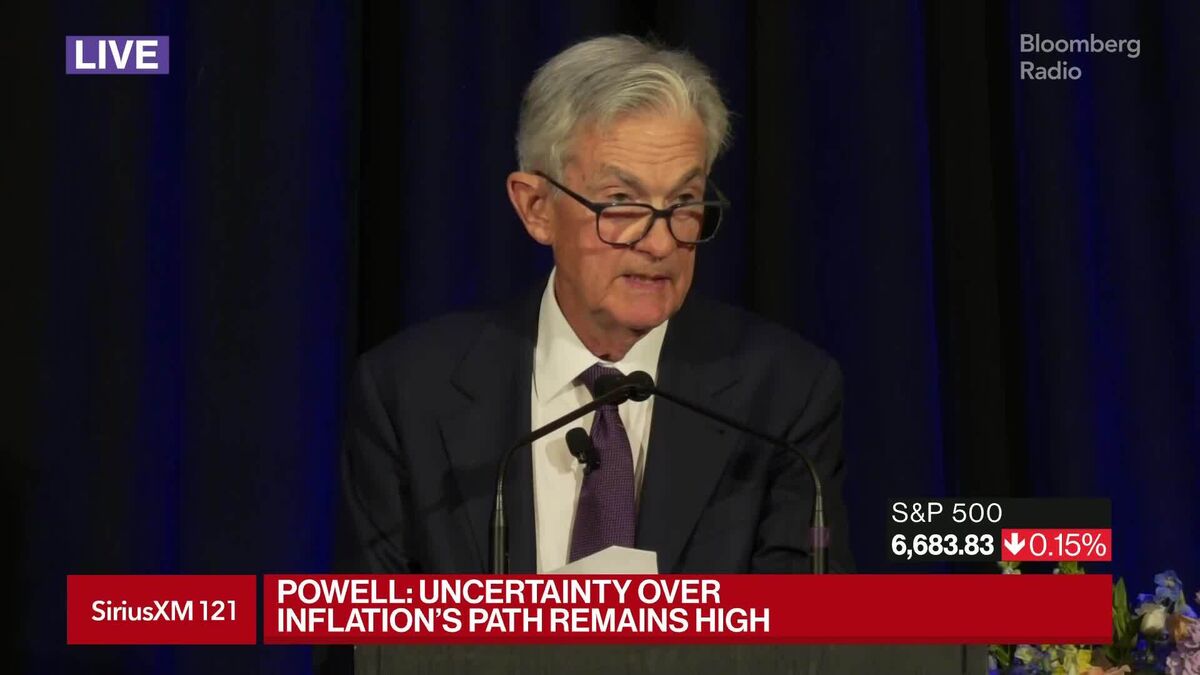

Powell: Calling the Fed Political Is a ‘Cheap Shot’ (Full Remarks)

NeutralFinancial Markets

Federal Reserve Chair Jerome Powell addressed the Greater Providence Chamber of Commerce, highlighting the challenging outlook for the labor market and inflation. He emphasized that the risks are two-sided, with inflation pressures potentially rising while employment faces downward risks. This statement is significant as it reflects the complexities policymakers face in deciding on interest-rate cuts, indicating that the economic landscape remains uncertain.

— Curated by the World Pulse Now AI Editorial System