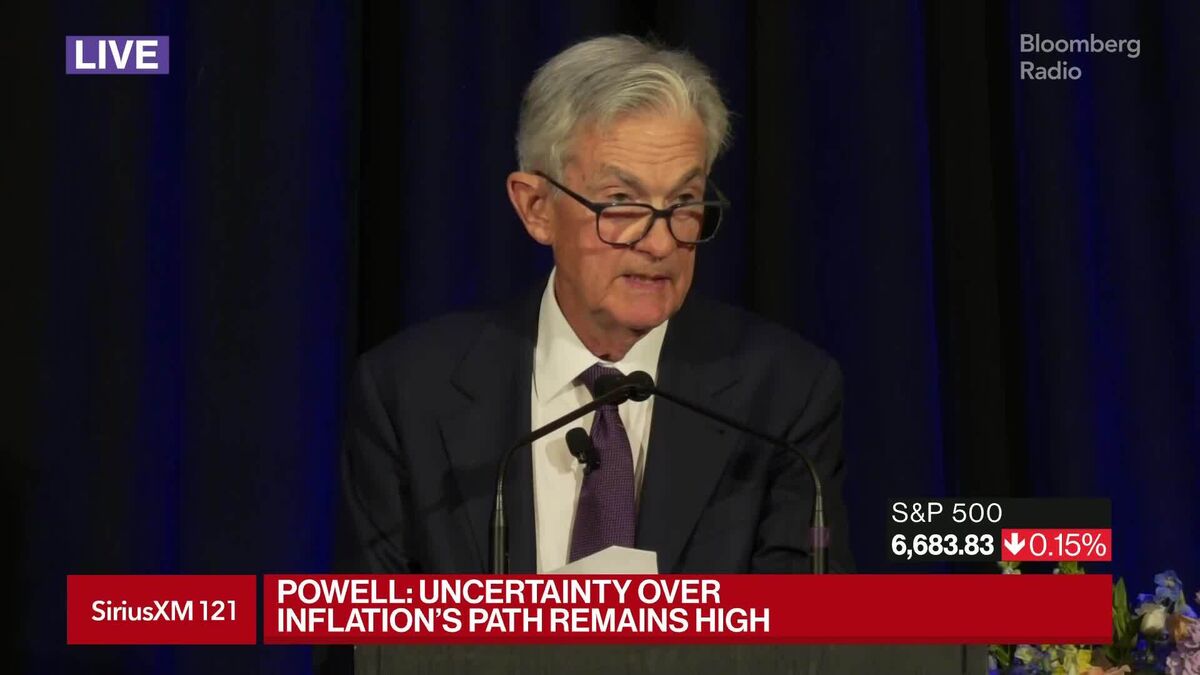

Tech Stocks Drag Indexes Lower, Snapping Winning Streak

NegativeFinancial Markets

Major U.S. stock indexes have taken a hit, breaking their recent winning streak, largely due to a decline in tech stocks. This downturn comes as Federal Reserve Chair Jerome Powell hinted at the possibility of further rate cuts, which could impact market dynamics. Understanding these shifts is crucial for investors as they navigate the changing landscape of the stock market.

— Curated by the World Pulse Now AI Editorial System