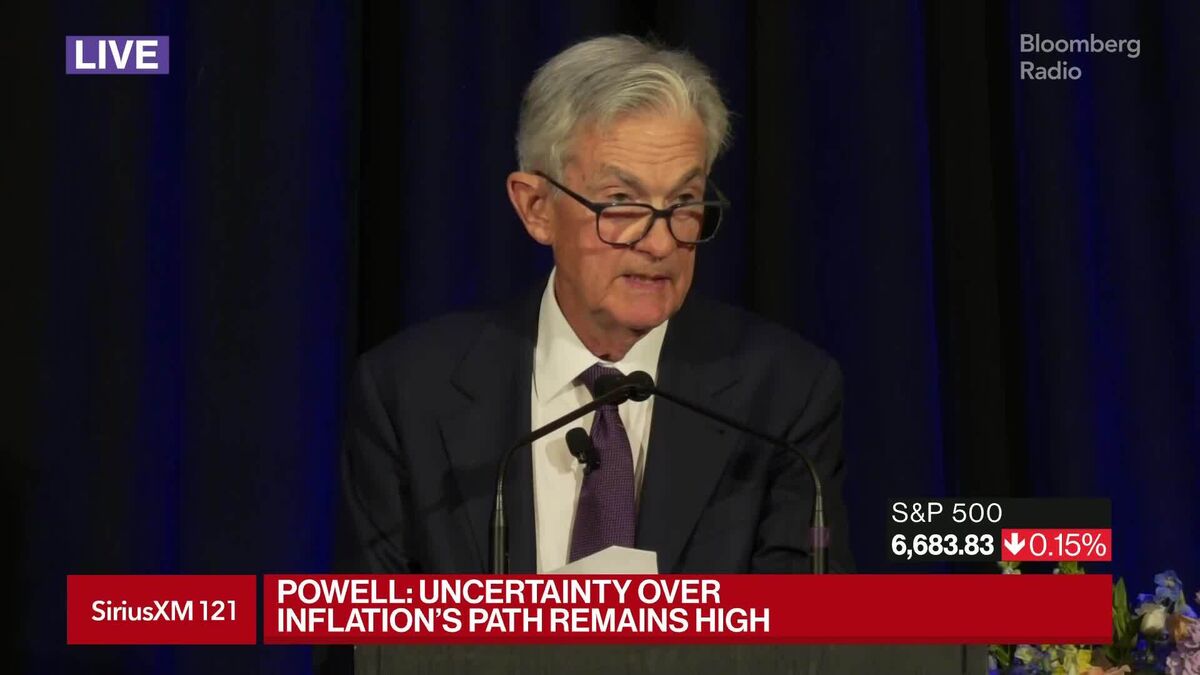

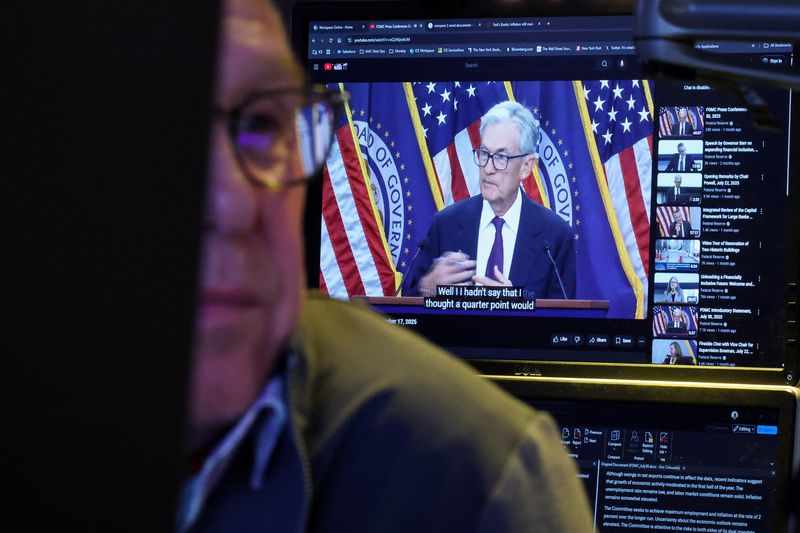

Fed’s Powell repeats no risk-free path as job, inflation risks weighed

NeutralFinancial Markets

Federal Reserve Chair Jerome Powell emphasized that there is no risk-free path for the economy as it navigates the challenges of job growth and inflation. This statement highlights the delicate balance the Fed must maintain in its monetary policy to support economic recovery while managing inflationary pressures. Understanding Powell's insights is crucial for investors and policymakers as they prepare for potential shifts in economic conditions.

— Curated by the World Pulse Now AI Editorial System