Oil settles up 1% on Russia sanctions, interviews for next US Fed chair

NeutralFinancial Markets

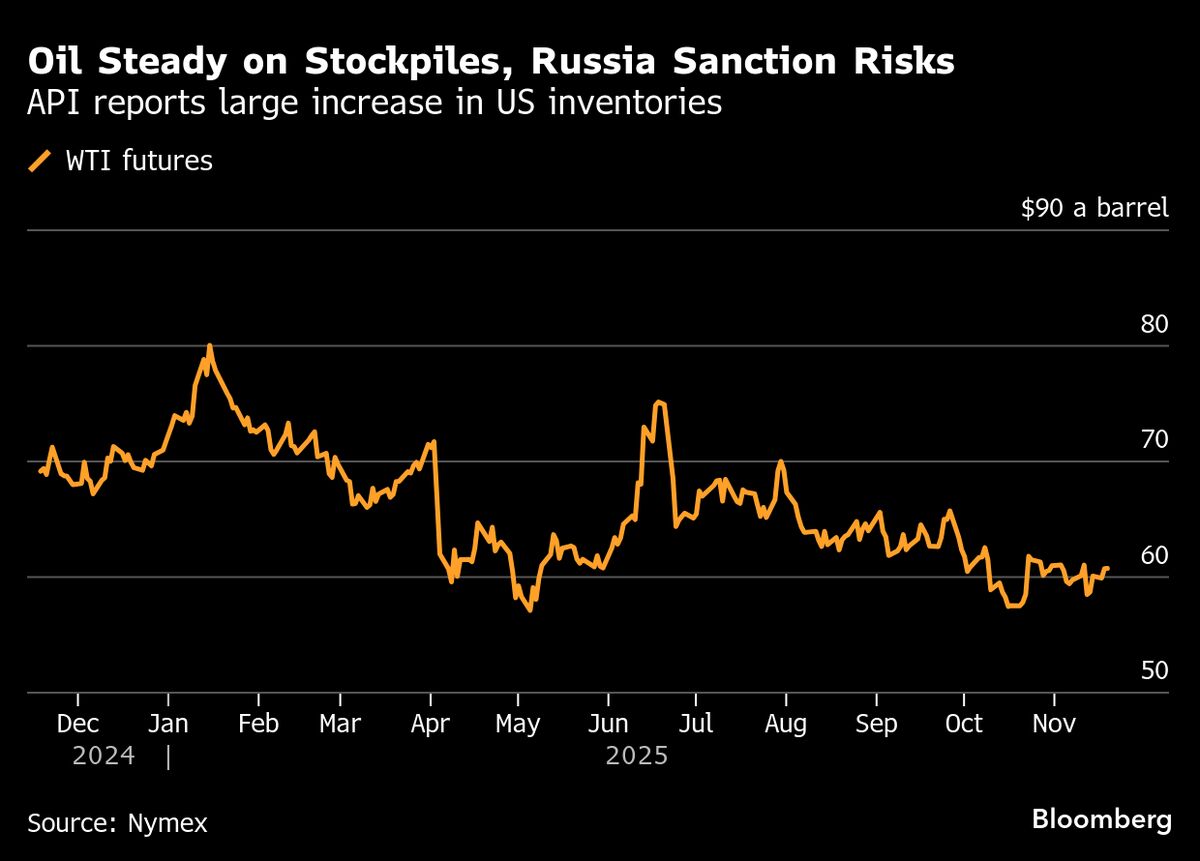

- Oil prices rose by 1% amid sanctions imposed on Russia and the anticipation of interviews for the next US Federal Reserve chair. This increase reflects market responses to geopolitical tensions and economic policies affecting oil supply.

- The sanctions aim to weaken Russia's financial capabilities, particularly targeting major oil companies, which are vital to its economy. The US Treasury has reported some success in this regard, indicating a potential shift in market dynamics.

- The stability of oil prices is being tested by the interplay of increasing US stockpiles and the ongoing sanctions against Russia. As traders assess these factors, the market remains vigilant about the potential repercussions on global oil supply and pricing strategies.

— via World Pulse Now AI Editorial System