Oil settles down on renewed push to end Russia-Ukraine war

NeutralFinancial Markets

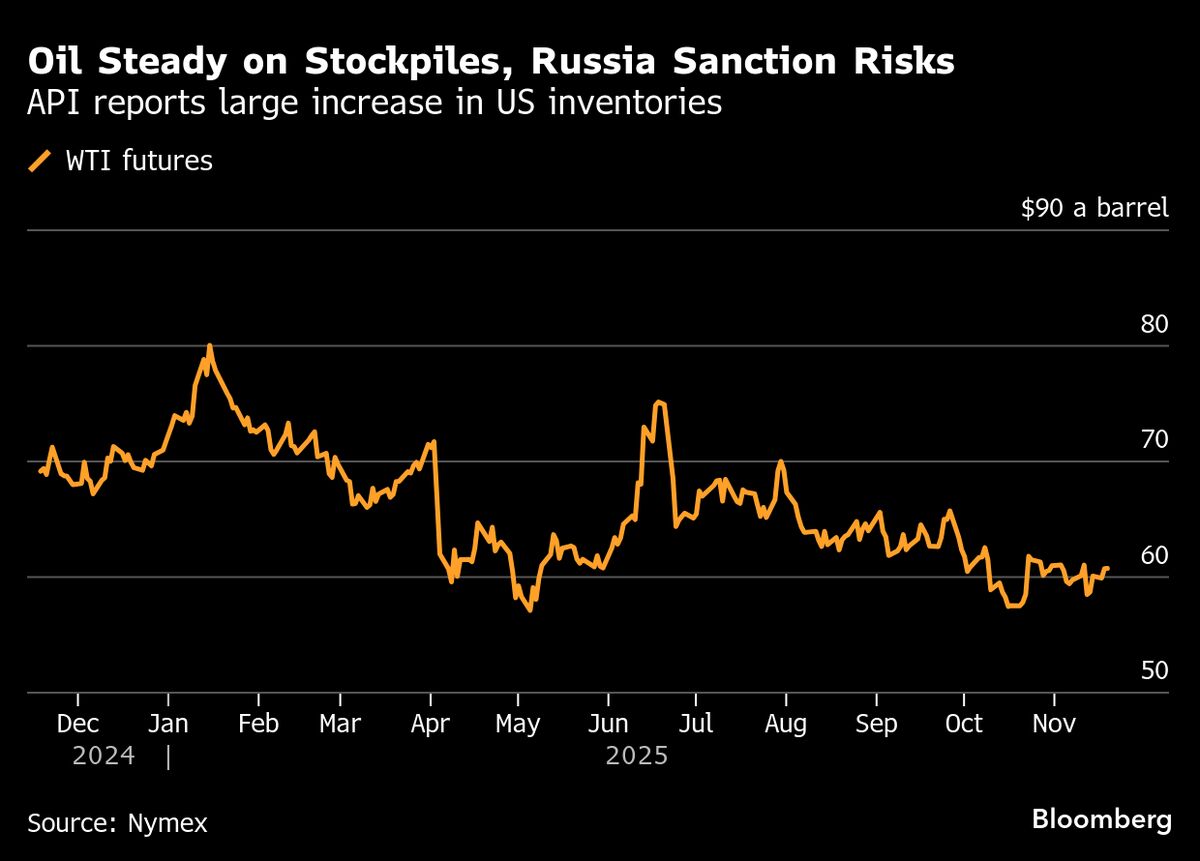

- Oil prices have decreased amid renewed U.S. efforts to facilitate peace negotiations between Russia and Ukraine, reflecting market reactions to geopolitical tensions.

- This development is crucial as it may signal a shift in the conflict, potentially impacting oil supply chains and pricing strategies for major producers.

- The situation is further complicated by ongoing sanctions against Russia, which have affected its oil exports and financial stability, highlighting the interconnectedness of geopolitical events and market responses.

— via World Pulse Now AI Editorial System