Russia aims to hit OPEC+ oil production quota by late 2025 or early 2026

NeutralFinancial Markets

- Russia is targeting to achieve the OPEC+ oil production quota by late 2025 or early 2026, indicating a strategic approach to stabilize its oil output.

- This development is significant for Russia as it seeks to maintain its position within the OPEC+ framework while navigating the complexities of international sanctions and market dynamics.

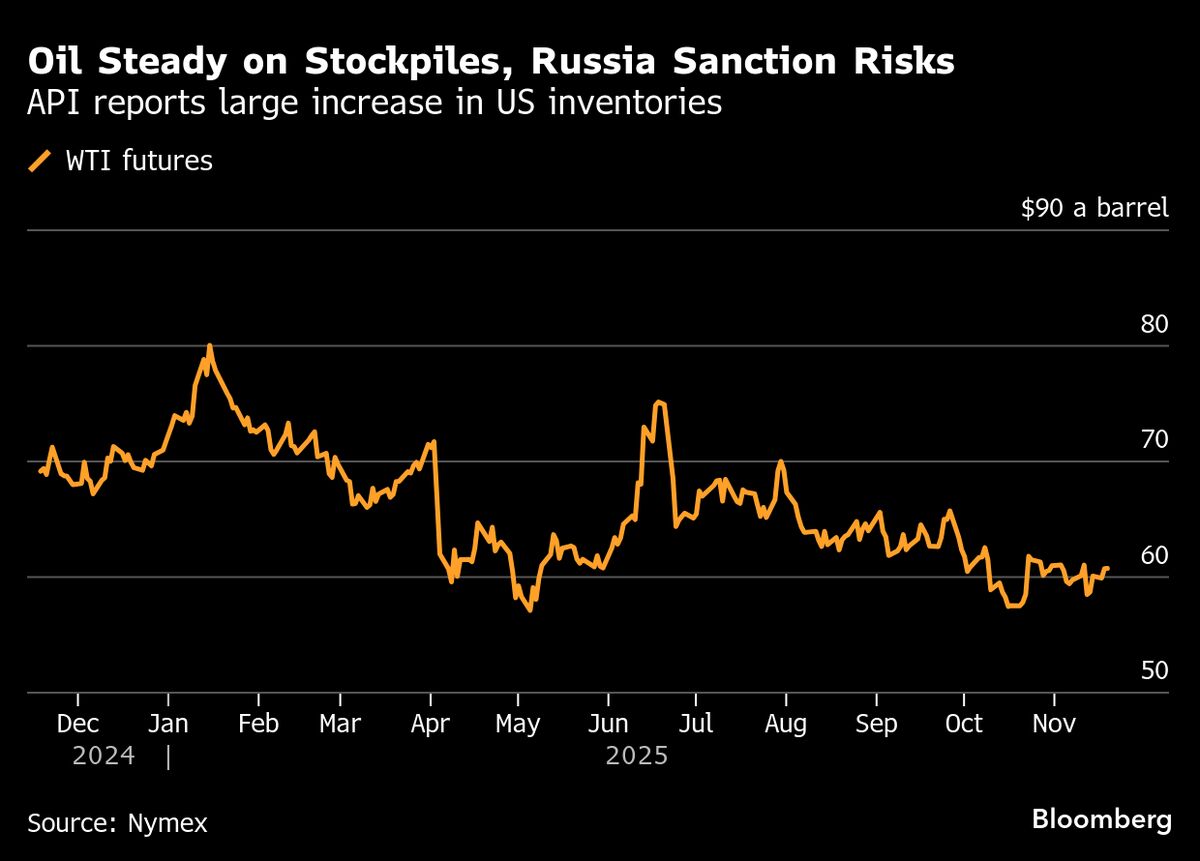

- The broader context reveals that oil prices are currently influenced by rising U.S. stockpiles and sanctions on Russia, creating a challenging environment for oil producers and impacting global supply

— via World Pulse Now AI Editorial System