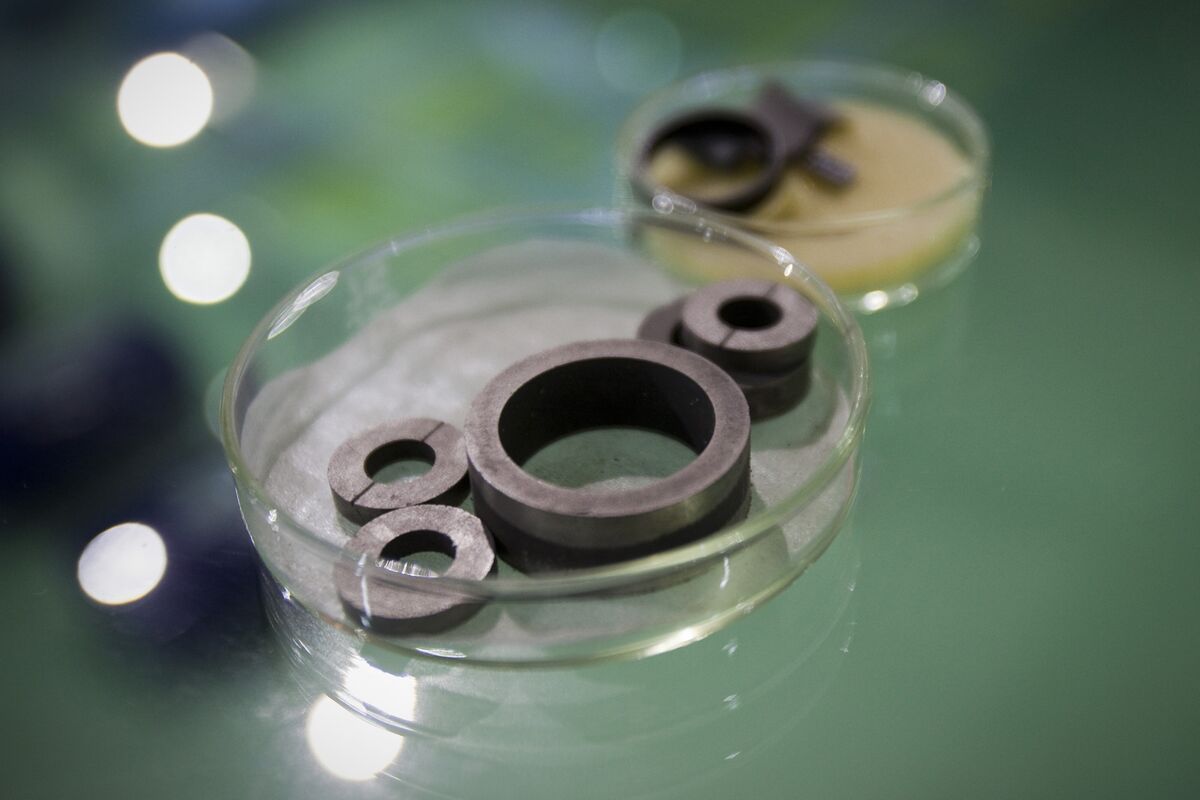

Is China about to win the race?

NeutralFinancial Markets

The article discusses the potential for China to surpass America in various global arenas. While much attention is given to America's current lead, the piece highlights that China possesses the necessary resources and strategic advantages to potentially take the lead. This matters because it could reshape global dynamics and influence international relations significantly.

— Curated by the World Pulse Now AI Editorial System