Dimon: Junior Bankers Learn More in the Office Than WFH

PositiveFinancial Markets

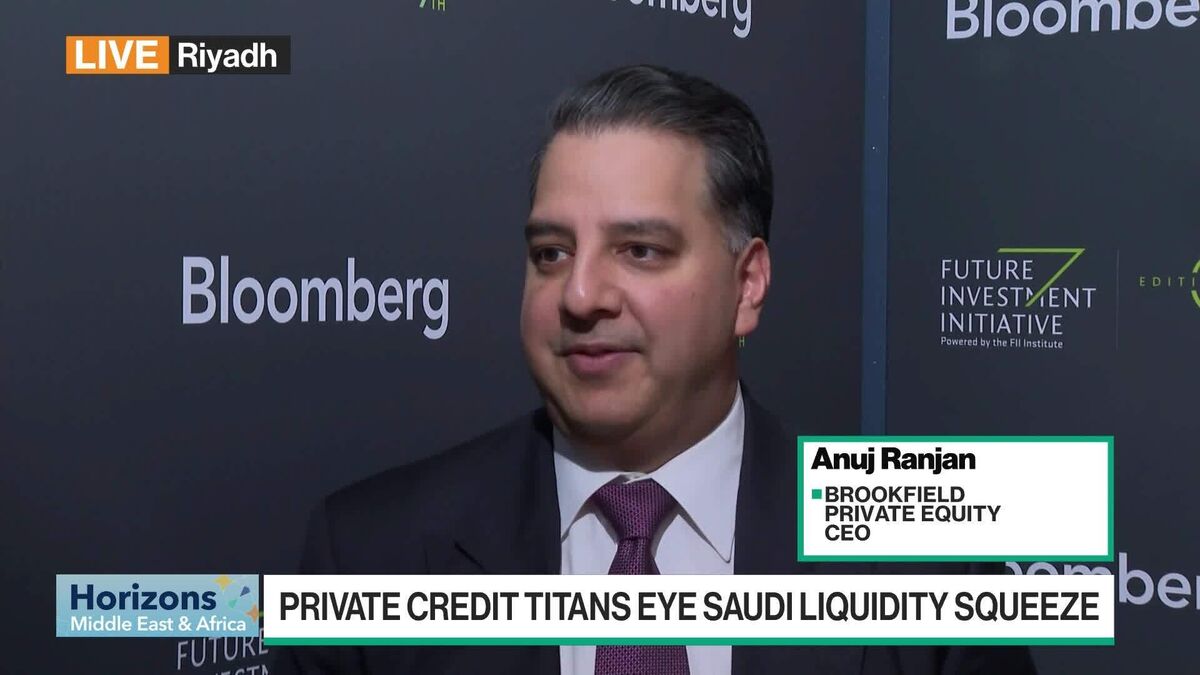

JPMorgan CEO Jamie Dimon emphasizes the importance of in-office work for junior bankers, stating that they learn more effectively in person than while working from home. During a panel at the Future Investment Initiative in Saudi Arabia, he highlighted concerns that younger employees are missing out on valuable learning opportunities. This perspective is significant as it raises questions about the future of remote work and its impact on professional development in the banking sector.

— Curated by the World Pulse Now AI Editorial System