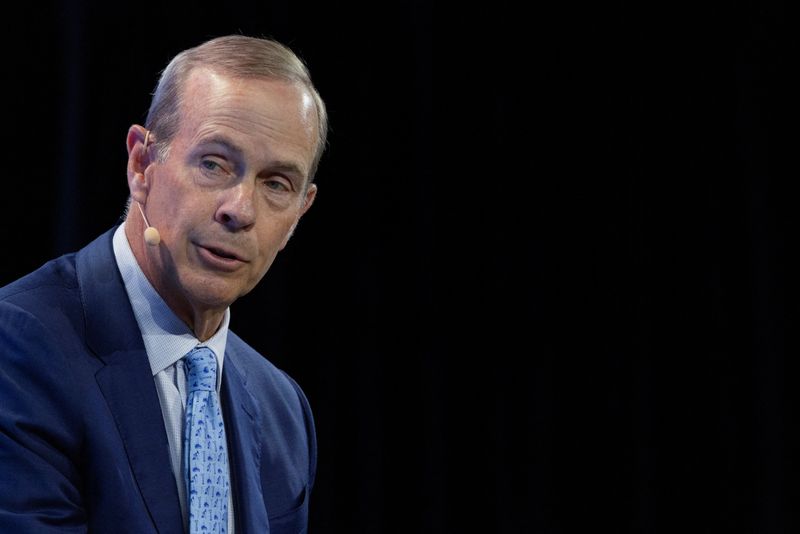

Chevron expects Hess acquisition to outperform targets, CEO tells employees

PositiveFinancial Markets

Chevron's CEO has shared optimistic news with employees regarding the recent acquisition of Hess, stating that the deal is expected to exceed performance targets. This acquisition is significant as it not only strengthens Chevron's position in the energy market but also reflects the company's commitment to growth and innovation. Employees can look forward to new opportunities and advancements as the integration progresses.

— Curated by the World Pulse Now AI Editorial System