Nvidia CEO drops bombshell on 68-year-old chip giant

NeutralFinancial Markets

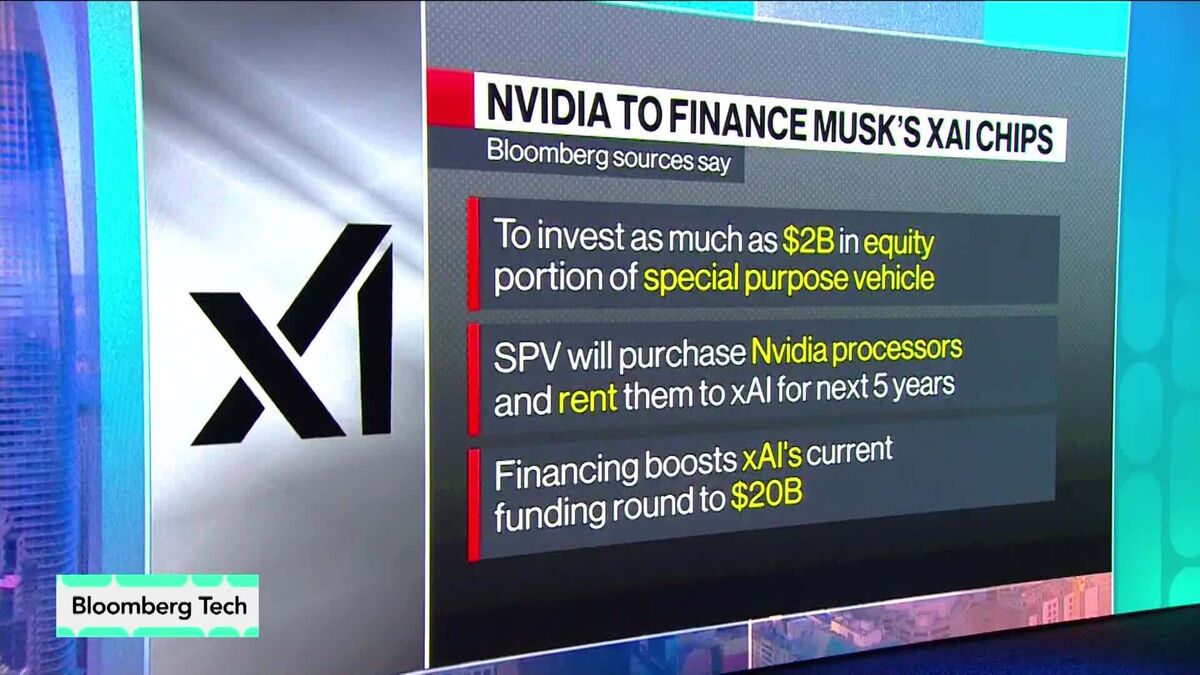

In a surprising turn of events, Nvidia's CEO made a bold statement regarding the longstanding competition with a 68-year-old chip giant. This revelation highlights the evolving dynamics in the tech industry, where established players are constantly challenged by innovative newcomers. Understanding these shifts is crucial for investors and tech enthusiasts alike, as they can signal future trends and opportunities in the semiconductor market.

— Curated by the World Pulse Now AI Editorial System