OPEC+ Lifts Oil, Ryanair CEO Blasts Reeves | Daybreak Europe 11/03/2025

PositiveFinancial Markets

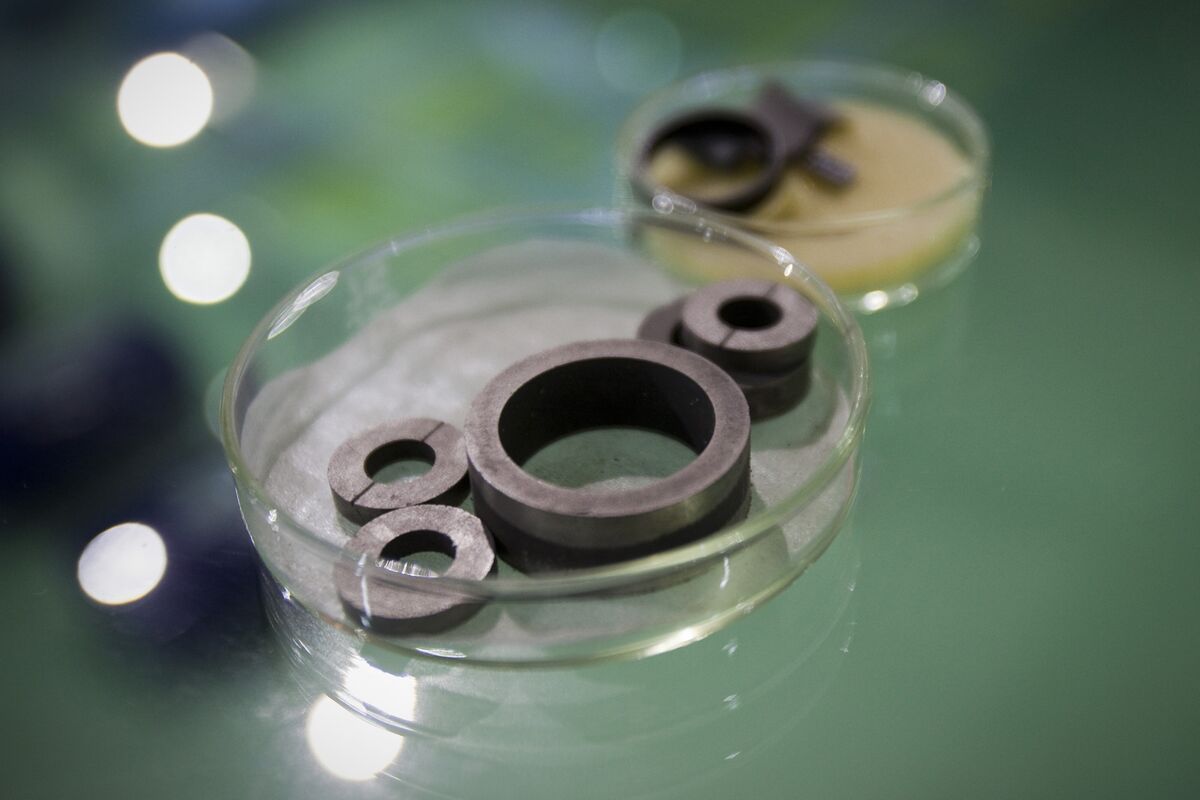

In today's Bloomberg Daybreak Europe, we see positive movements in the oil market as OPEC+ decides to maintain current output levels, leading to a fourth consecutive day of gains. This decision is significant as it reflects the group's strategy to stabilize prices amidst fluctuating demand. Additionally, the White House's announcement that China will suspend certain rare earth curbs and investigations into US chip companies adds to the optimistic outlook for investors, suggesting a potential easing of trade tensions.

— Curated by the World Pulse Now AI Editorial System