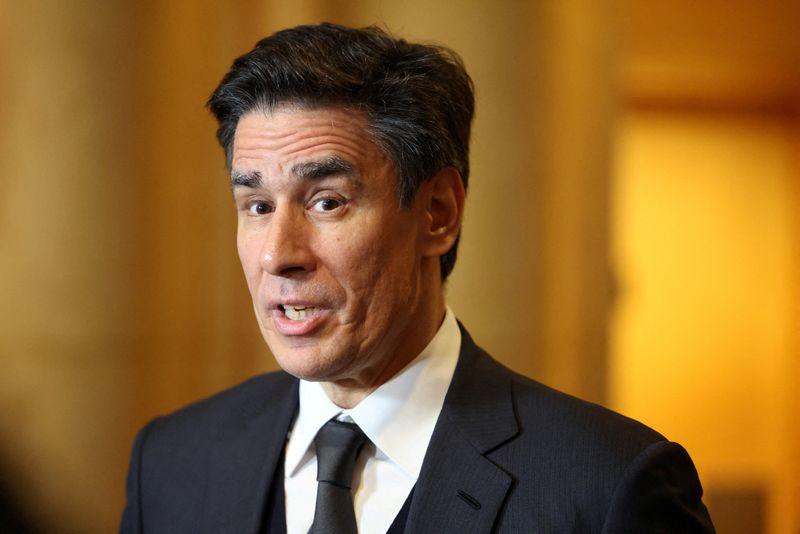

Lightwave Logic extends CEO contract, CFO to retire at year-end

PositiveFinancial Markets

Lightwave Logic has announced the extension of its CEO's contract, signaling confidence in the company's leadership and future direction. Meanwhile, the CFO is set to retire at the end of the year, marking a significant transition for the company. This news is important as it reflects the company's stability and ongoing commitment to growth, even as it prepares for changes in its executive team.

— Curated by the World Pulse Now AI Editorial System